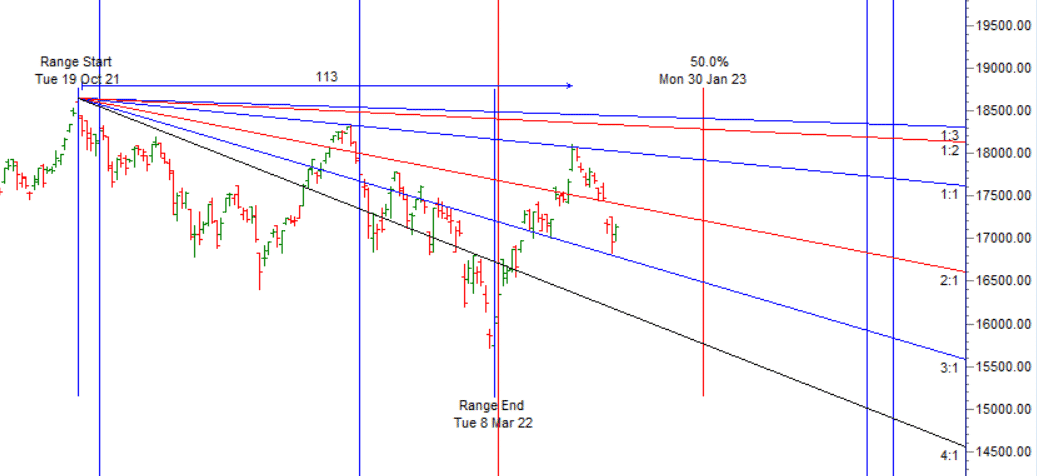

As discussed in last analysis We have seen impact of gann date with Astro date. Today was the important gann date as shown below and we have touched the gann angle suggesting we might has done price time squaring, and can see relief rally till we are holding 16824. Bulls need to move above 17012 for a move towards 17078/17144/17209/17275. Bears will get active below 16947 for a move towards 16881/16815/16749. We got a perfect bounce above 17012 and did 2 targets also formed inside bar pattern. Now Bulls need to move above 17213 for a move towards 17278/17343. Bears will get active below 17084 for a move towrds 17019/16954.

Intraday time for reversal can be at 9:15/10:01/10:51/1:40/2:07/2:44 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17150 PCR at 0.92 , Rollover cost @17418 closed below it. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty April Future Open Interest Volume is at 0.84 Cores with liquidation of 11.7 Lakh with decrease in cost of carry suggesting SHORT positions were closed today.

The Option Table data indicates decent support at 17000 and reasonable resistance at 17300 . There is total OI of 10.06 Cores on the Call side and 7.77 Cores on the Put side, So, the activity is more on the CALL side, indicating option writers are in BEARISH zone.

FII’s sold 3009 cores and DII’s bought 2645 cores in cash segment.INR closed at 76.23.

06 April was Mars and Saturn Aspect ,High of 18095 and 17921 is valid for whole year Mark in on your charts and take trade on break of High and Low.

17261 is next important level to watch out for 200-300 points move. —High made on Friday 17275 and we got our 300 points move.

“The Market Doesn’t Give a Damn What You Think, about your economic or political views. Trade what the market is doing, not what you’d like it to do in your wildest fantasies.”

For Positional Traders Stay long till we are holding Trend Change Level 17623 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 17130 will act as a Intraday Trend Change Level.