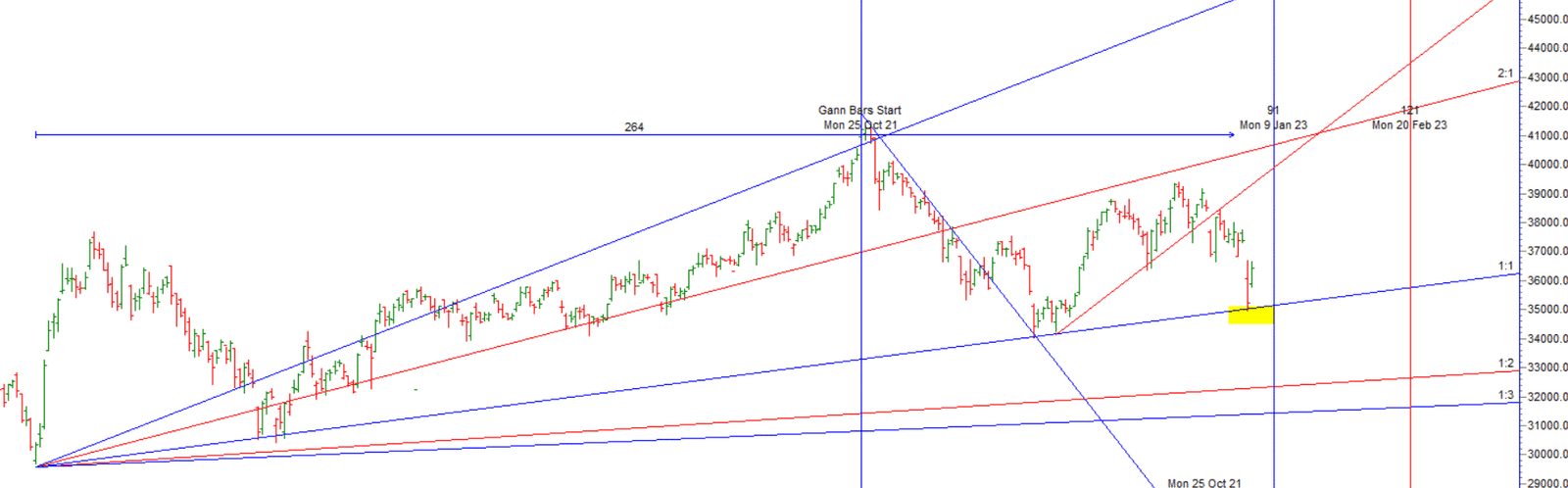

As discussed in Last Analysis We opened with Huge gap down and saw deep cut in Bank Nifty tune of 2163 points and we are back to gann 1×1 line support. Fall can extend more as bank nifty closed below its 200 DMA, Bears need to move below 34990 for a move towards 34790/34418/34048. Bulls will have chance above 35540 for a move back to 35729/35918/36200. Gap Up open as Price took support at 1×1 line and rallied big time. We have many astro event happening in weekend but most important is Venus Trine North Node Mars Trine North Node. Mars and Venus Aspect with Rahu it will create lot of voaltlity and wild swing so trade with less position size.First 15 mins High and Low will decide the trend for the day. For Swing Traders Bank Nifty need a clos above 36639 for a move towards 37032/37191/37452 Bears will get active below 36246 for a move towards 36000/35500/35000.

Intraday time for reversal can be at 9:48/10:44/11:11/12:35/1:05/2:22 How to Find and Trade Intraday Reversal Times

Bank Nifty March Future Open Interest Volume is at 17.8 lakh with liquidation of 2.7 Lakh contract , with increase in Cost of Carry suggesting SHORT positions were closed today.

MAX Pain is at 36400 and PCR @0.93 Rollover cost @37206 closed below it.

Talking about supports and resistance based on OI at this stage is not quite relevant because, with the kind of Voaltality going on, no strike is safe as 1 day we are down 2000 points and other day 1000 point up.The option table is undergoing a real transformation – with each day one PE level is targeted with huge volumes of writing and the strike is giving way to much lower strikes.

The critical quality needed to make money in this kind of market, where trends will flip on no notice is: Extreme flexibility Be prepared to flip your positions and trades with market flavour.It is always the minority which wins in the markets. So, be open for possibilities.

The escalation in the Ukraine conflict comes at a time when financial markets were already grappling with surging inflation and the economic impact of hawkish central bank policies. All eyes are now on the Federal Reserve’s policy meeting next month, where analysts still expect it to raise interest rates, but deliver fewer-than-expected hikes through the rest of the year.

For Positional Traders Trend Change Level is 36152 on Futures and go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 36408 will act as a Intraday Trend Change Level.

Buy Above 36820 Tgt 37000, 37211 and 37500 (Bank Nifty Spot Levels)