As Russia and Ukraine was Boils markets seem panicky. But if history is anything to go by, Wars represent a opportunity rather than a threat for the prepared investor.

While we have had thousands of wars over hundreds of years, I have picked the most well known among them for the sake of simplicity as well as the fact that the damage these did (human and otherwise) was the biggest we have ever seen.

World War I

The US declared war on Germany in 1917, and that sent stocks tumbling. That downward trend continued into 1918, at which point the market crept up slowly in fits and starts. It wasn’t until mid-1919 that the US stock market fully recovered on the news that the war was over and the Versailles Treaty signed.

In the six months following the onset of World War I in 1914, the Dow fell more than 30%. Because the war basically ground the business world to a halt and market liquidity all but dried up, the decision was made to close the stock market that year. This lasted for six months, the longest such period on record. Making up for lost time, the Dow rose more than 88% in 1915 after it reopened, which remains the highest annual return on record for the DJIA. In fact, from the start of the war in 1914 until the war ended in late 1918, the Dow was up more than 43% in total or around 8.7% annually.

Stock Markets during the second World War

“Then in May 1942, just before the United States’ military fortunes in the Pacific improved, in the midst of the gloom and the bargains and at the point of maximum bearishness, the U.S. stock market made a bottom for the ages.”

“It’s interesting how well the stock market performed after mid-October in spite of another avalanche of very bad war news (…) it must have sensed the rising odds of the United States being drawn into the war. Another example of the wisdom of markets. (…) The war news was consistently bad, but nevertheless stocks worked higher.”

A bit different from what happened in World War I with markets actually slowing moving down as hostilities in Europe opened up (do note that US did not officially enter the War until the bombing at Pearl Harbor). But by the time America entered, markets had already bounced of the bottom and once the war ended, we saw a multi decade bull market with the levels being seen during World War II never being seen again (more due to change of world order which was purely due to the War).

Gulf War

The Gulf War lasted just seven months, from August 2, 1990, through February 28, 1991. Its brevity makes it difficult to separate market changes caused by the conflict from those related to other world events. For example, oil prices spiked during this period, which caused a brief recession – an unusual economic state during war time.

It’s worth noting that the stock market may have responded differently to the Gulf War than it had to previous wars because of a distinct shift in the US economy. Processing natural resources and manufacturing capital goods were key components of the economy during previous wars, and those sectors saw substantial growth during war time.

The Invasion of Kuwait by Iraq resulted in the first Gulf War and in a way what we see today in Iraq is a indirect result of that decision by Saddam Hussein. In the last 25 years, while much of the world has improved by leaps and bounds, Iraq has gone so back that it will take years just for it to get back to where it stood in 1990 (even accounting for the devastation they saw during the Iran-Iraq war).

Markets rebounded strongly and on the charts, appears as a mere blip in the long bull rally Dow saw between 1987 to 2000.

If there was any hope for Iraq to become a normal country again, the Second Gulf War more or less buried any hope. Markets though loved this war too and in a way can be seen as the first major rise in the 2003-2008 bull rally.

The terrorist attack on U.S. soil on Sept. 11, 2001 saw stocks fall sharply, down almost 15% in less than two weeks following the tragedy. The economy was already in the middle of a recession at that point, and stocks were in a free fall from the bursting of the dot-com bubble. But within a couple of months, the stock market had made back all of the losses that occurred in the aftermath of 9/11.

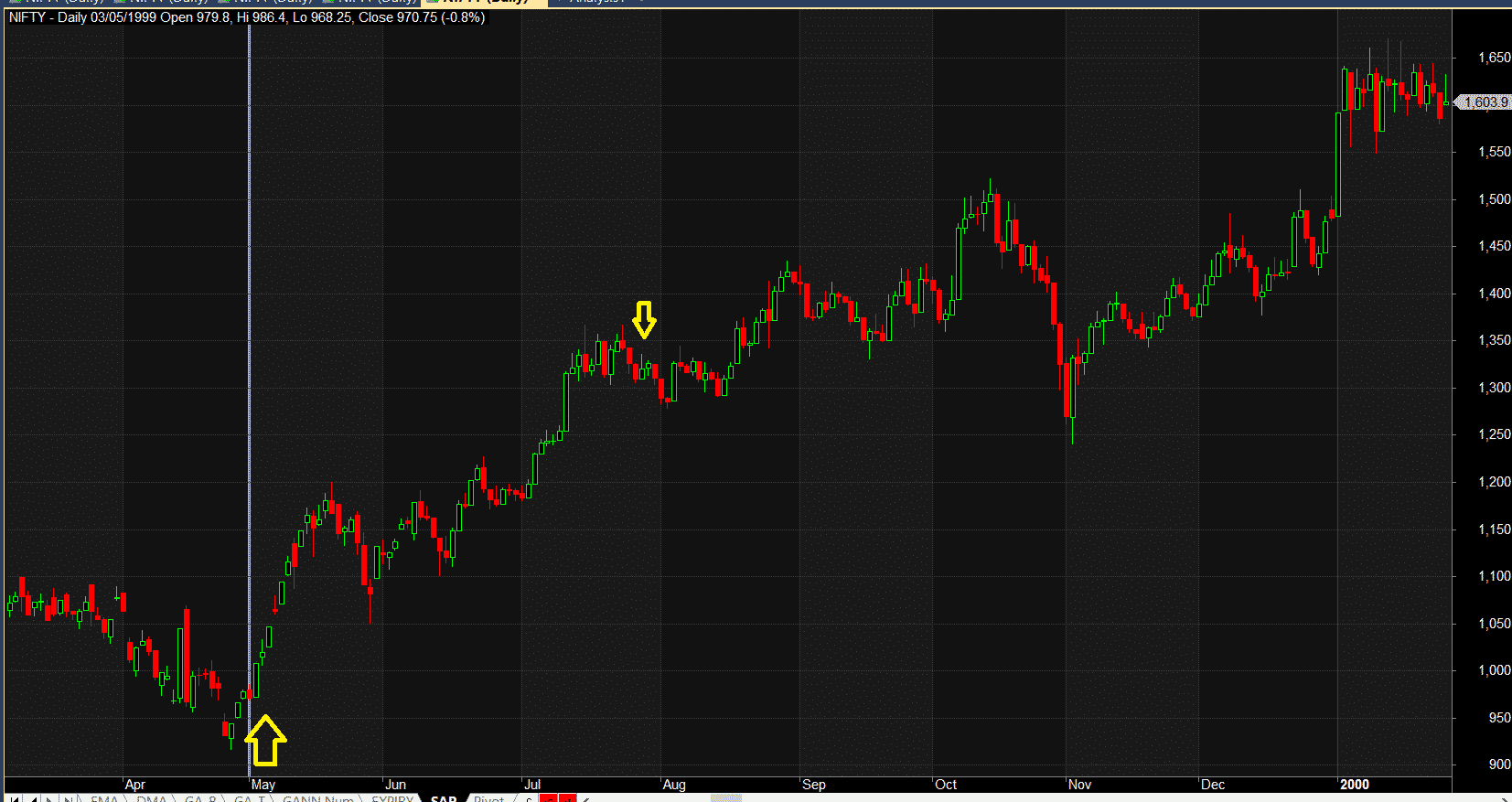

Kargil War

The Kargil War, also known as the Kargil conflict, was an armed conflict fought between India and Pakistan from May to July 1999. Nifty made Botom once War was announced and Rallied till was was Over in July 1999

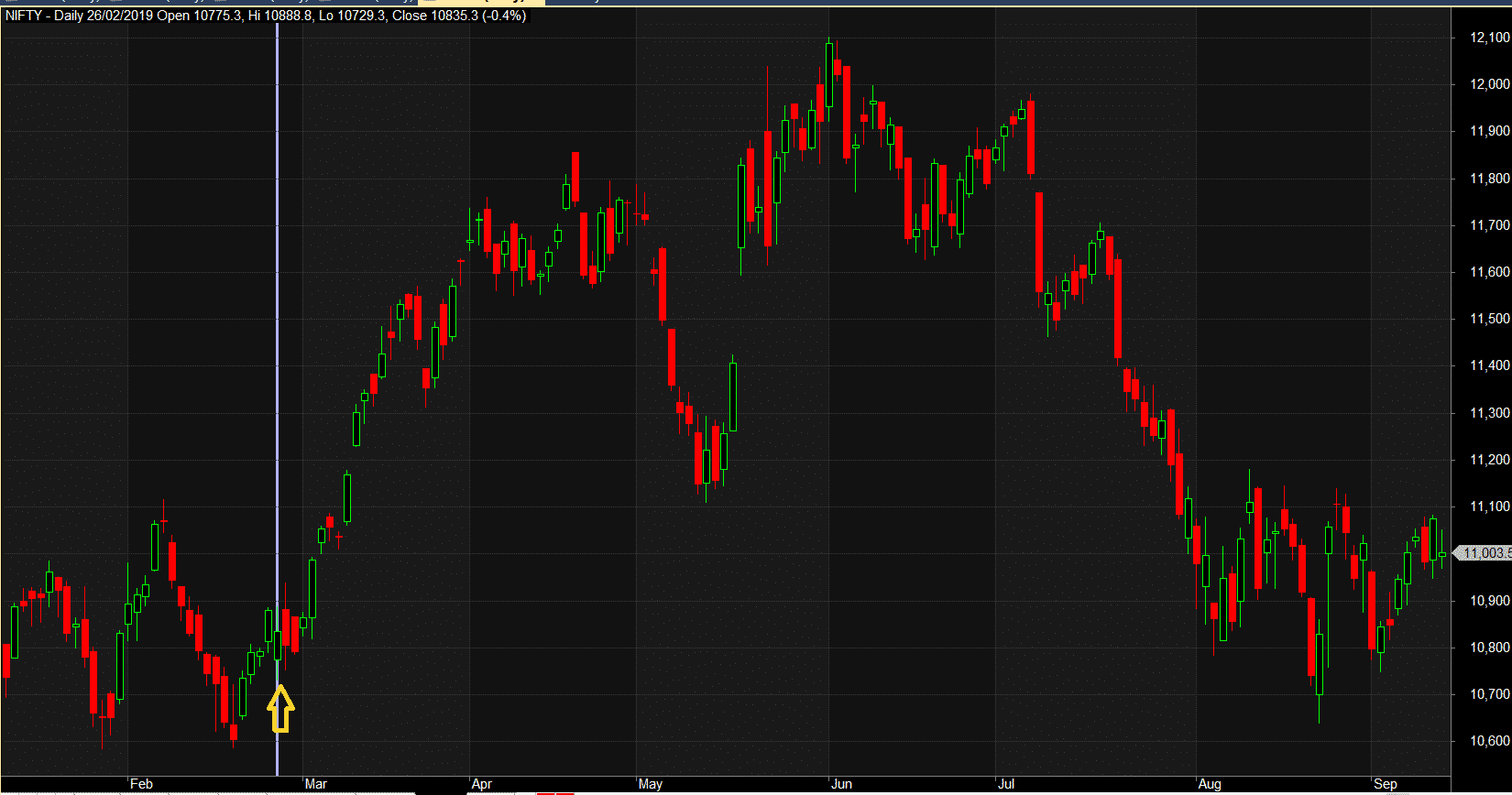

Surgical Strike 1

Surgical Strike on 26 Sep we made Top and saw a good Decline

Surgical Strike 2

26 Feb 19 Surgical Strike made a Major Bottom

The key takeaways from the historical analysis are that shares initially fall as markets assess risk, but history suggests that within six months, they always rise strongly.

Of course, the world is changing, and historical patterns may not hold true in future conflicts. Stock market behavior is heavily dependent on context, as well as myriad internal and external factors that combine to create long-term trends – for example, earnings, valuation, inflation, interest rates, and overall economic growth. That means, regardless of world events, investors should maintain proven strategies to protect and grow portfolios.

Jack said – “Look kid, if you hear the missiles are flying, you buy them. You don’t sell them.”

“You buy them?” I said, somewhat puzzled.

“Sure you buy them!” said Jack. “Cause if you’re wrong, the trade will never clear. We’ll all be dead.”

Dear Mr.Brahmesh,

Instead of taking a risk during uncertainty of War, need to analyse what happens after the war also.