Indian Union Budget will be presented on 01 Feb 2022 , Nifty and Bank Nifty remains in a wide range so there is an opportunity to trade in Nifty and Bank Nifty Options And the opportunity could turn out to be quite promising.

What will be market direction post budget we do not know so its best we take a position that is completely independent of the direction of the market and possibly make money out of it.

Though we dont have an idea of the direction, historically, the maximum change in Nifty from the budget date to the next expiry date is quite decent in either direction. So, we can fairly assume that the move post budget is going to be big as it always is. So lets discuss the Option Strategy

Long Straddle Strategy

A long straddle strategy is when you buy a Put Option and a Call Option of the same expiry and at the same strike. As most of retail investor will prefer trading the Option Route to trade ( They should not trade but still they cannot resist the temptation of not trading 😉 ).Yeah, offcourse, there could be a loss. There is nothing called ‘100% probability of profit’ in stock market. But, definitely we can identify strategies with bear minimum losses and with a good potential of profit.

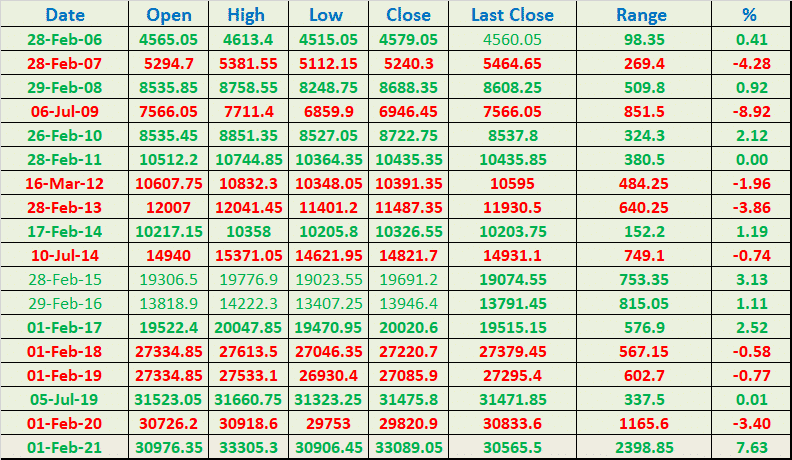

Nifty Movement on Budget Day

BANK Nifty Movement on Budget Day

The above depicts the Volatility and Range Expansion Nifty has witnessed in past 26 Budget session and Bank Nifty is past 16 Budget Session.Just by going at the sheer number its looks mind boggling. So Stop Losses are must for traders on Budget day. Traders who are weak heart having small capital till 5 lakhs and cannot digest the bout of volatility you are going to witness just stay away from market for Budget day. I know its difficult to control your emotions not to trade on such volatile day but if your caught on wrong side of trade you can lose big chunk of your capital in matter of minutes.

So Following Option Strategy can be used to play the Budget day:

A long straddle is the best of both worlds, since the Call Options gives you profit if Nifty goes up and the Put Options gives you Profit if Nifty goes down at a particular strike price . But those rights don’t come cheap, because as the Budget day come nearer Implied Volatility of Nifty Options will rise which in turn will increase the price of Options. As soon as the event is over the IV will come down drastically and there will be huge fall in Option Premium.

The goal is to profit if the stock moves in either direction. Typically, a Straddle will be constructed with the Call and Put at-the-money ie. Suppose Nifty is trading at 17300 so trader will eye on 17300 Call and 17300 Put . Buying both a call and a put increases the cost of your position, especially for a volatile stock. So you’ll need a fairly significant price swing just to break even.

Long straddle options are unlimited profit, limited risk (Risk of Losing the whole capital if proper Stoploss are not maintained) options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. By Having Long Positions in Both Call and Put Options, Straddles can achive Large Profit no matter which way the underlying Stock Prices Heads, Provided the move in strong enough.

Profit Calculation:

- Price of Underlying – Strike Price of Long Call – Net Premium Paid

- Strike Price of Long Put – Price of Underlying – Net Premium Paid

Loss Calculation:

- Max Loss = Net Premium Paid + Commissions Paid

- Max Loss Occurs When Price of Underlying = Strike Price of Long Call/Put

Breakeven Points

- Upper Breakeven Point = Strike Price of Long Call + Net Premium Paid

- Lower Breakeven Point = Strike Price of Long Put – Net Premium Paid

Lets discuss with an Example of Last Budget on Both Nifty and Bank Nifty.

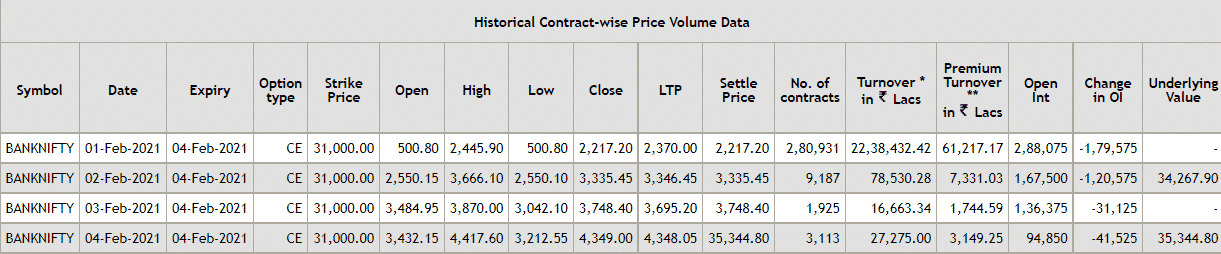

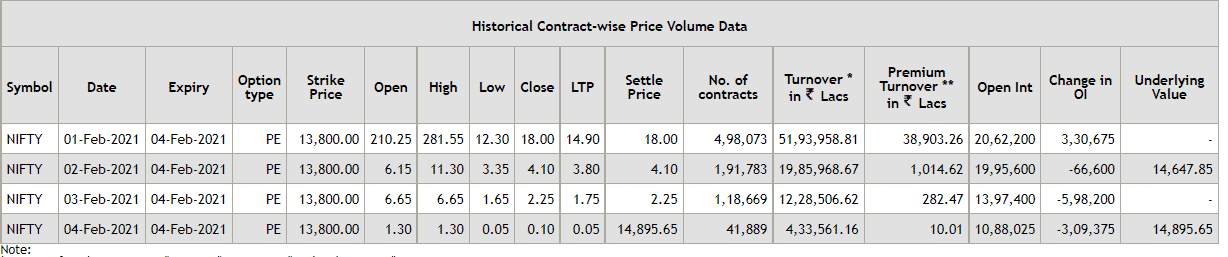

On 01 Feb 2021 Nifty Opened at 13759 and Bank Nifty Opened at 30976.

ATM Options will be 13800 and 31000 for 04 Feb Weekly Expiry

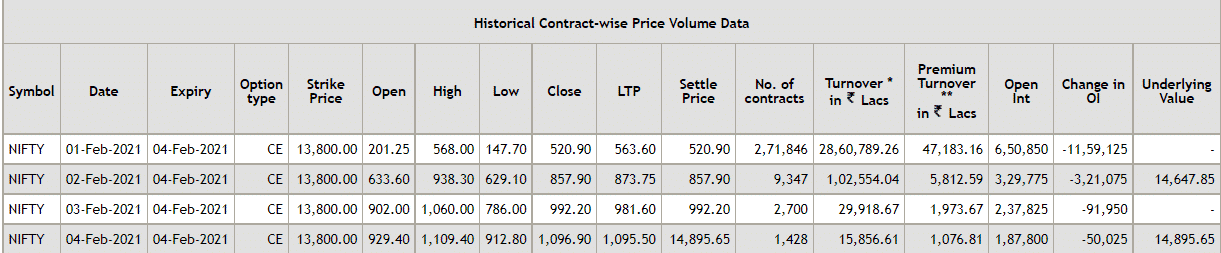

13800 CE opened at 210 and 13800 PE opened at 201 as seen in below screenshot. Total Premium paid was 410.

Upper Breakeven Point: 13800+410= 14210

Lower Breakeven Point: 13800-410= 13390

Nifty gave a Big Move and CE closed at 1096 and Put closed at 0

Traders who held till expiry made profit of 1096-410=686 points

Lot Size of Nifty was 75 means a profit of 51450 per lot.

Capital Deployed is 30750 Giving more than 160% Return per lot in 4 trading sessions.

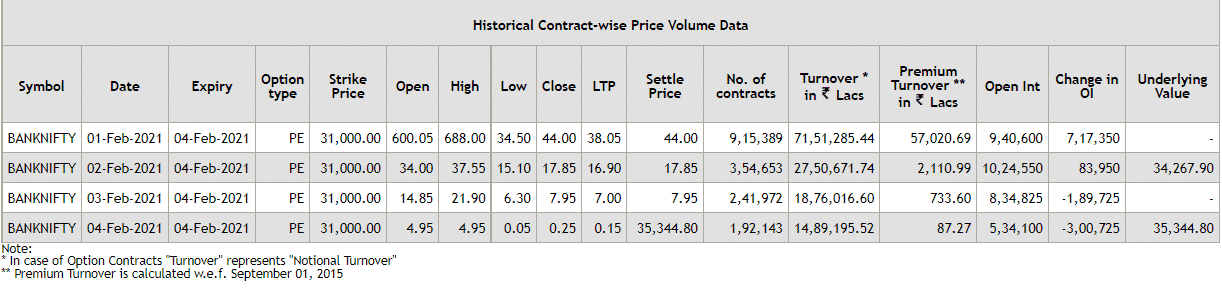

31000 CE opened at 600 and 31000 PE opened at 500 as seen in below screenshot

Upper Breakeven Point: 31000+1100= 32100

Lower Breakeven Point: 31000-1100= 29900

BANK Nifty gave a Big Move and CE closed at 4349 and Put closed at 0

Traders who held till expiry made profit of 4349-1100=3249 points

Lot Size of Nifty was 25 means a profit of 81225 per lot.

Capital Deployed is 27500 Giving around 300% Return per lot in 4 trading sessions.