- FII sold 3.8 K contract of Index Future worth 190 cores, Net OI has decreased by 17 K contract, 6.6 K Long contract were added by FII and 10.4 K Shorts were added by FII. Net FII Long Short ratio at 0.72, So FII used fall to enter longs and enter shorts.

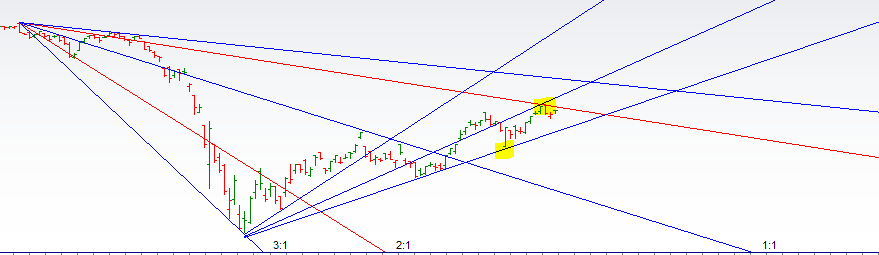

- As discussed in last analysis As yesterday was an important Astro date with Venus moving to Gemini which is considered as Barren Sign which generally leads to negative price,so break of High and Low of 25 will decide the next 150-200 points move in Nifty. Bulls need to break 10361 for a move back to 10421/10499/10555. Bears will get active below 10258 for a move back to 10209/10158/10108/10060. Till bulls are holding 10361 Nifty can rally towards 10421/10499/10555. Bears will get active below 10270 for a move back to 10209/10158/10108/10060.

- Intraday time for reversal can be at 10:25/12:59/1:48/2:18 How to Find and Trade Intraday Reversal Times

- Total Future & Option trading volume at 8.5 Lakh core with total contract traded at 2.29 lakh , PCR @0.89

- Nifty July Future Open Interest Volume is at 1.16 Cores with addition of 0.99 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @10325 closed below it.

- 10400 CE is having Highest OI at 4 Lakh, resistance at 10400 followed by 10500.10200-10600 CE added 12 Lakh in OI so bears added in range of 10400-10600.FII bought 35.9 K CE and 21.4 K CE were shorted by them. Retailers bought 164 K CE and 170 K CE were shorted by them.

- 10200 PE OI@10 Lakhs having the highest OI strong support at 10200 followed by 10300. 10100-10300 PE added 8 Lakh in OI so bulls added position in range 10100-10200.FII bought 25.3 K PE and 24.9 K PE were shorted by them. Retailers bought 151 K PE and 126 K PE were shorted by them.

- FII’s sold 753 cores and DII’s bought 1304 cores in cash segment.INR closed at 75.80

- Nifty Futures Trend Deciding level is 10294 For Intraday Traders). NF Trend Changer Level (Positional Traders) 10269 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy Above 10410 Tgt 10430,10460 and 10496 (Nifty Spot Levels)

Sell Below 10324 Tgt 10300,10270 and 10225(opens in a ne (Nifty Spot Levels)

- Follow on Twitter:https://twitter.com/brahmesh

- Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

- Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ

- Trading Course Details: http://www.brameshtechanalysis.com/online-technical-analysis-course/

Sir can you please can you help me with a technical analysis of nmdc