- FII’s sold 14.8 K contract of Index Future worth 1103 cores 5.7 K Long contract were liquidated by FII’s and 9.1 K Short contracts were added by FII’s. Net Open Interest increased by 3.3 K contract, so rise in Nifty was used by FII’s to enter long and enter short in Index futures.FII’s Long to Short Ratio at 1.23 How Comfortable you are with your trading ?

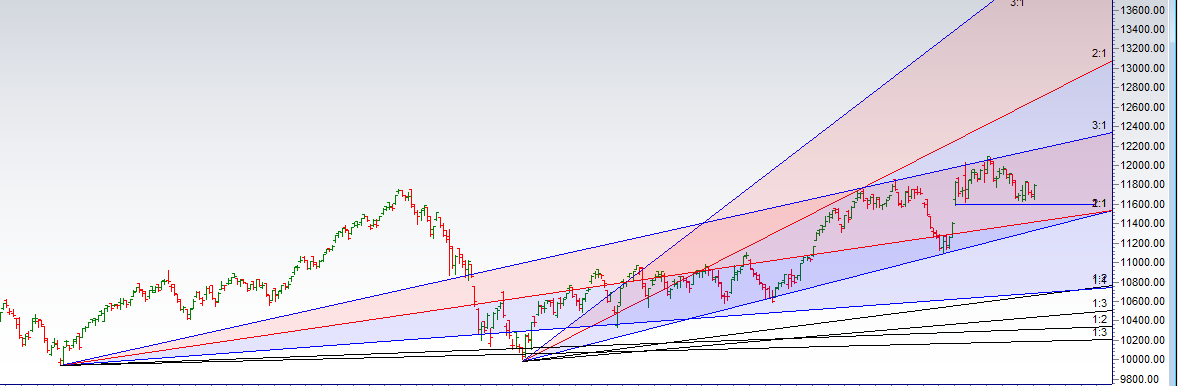

- As Discussed in Last Analysis 24 June High and low are very important and we should see a good move in Nifty in next 2 days. Fresh Positional long should be taken above 11710 for a move back to 11790/11848/11919. Bears will get active below 11650 for a move back to 11600/11555/11485.

- Low made today was 11651 bulls once above 11710 rallied and did our 1 target of 11790 now waiting for 11848/11919. Bears will get active only below today close of 11651. Gann Time Cycle again helped us in capturing the bottom today.

- Important intraday time for reversal can be at 10:15/11:24/1:11/2:15 How to Find and Trade Intraday Reversal Times

- Nifty June Future Open Interest Volume is at 1.33 core with liquidation of 23.9 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @11954 closed above it.

- Total Future & Option trading volume at 11.57 Lakh core with total contract traded at 1.09 lakh , PCR @0.90

- 12000 CE is having Highest OI at 39.2 Lakh, resistance at 12000 followed by 12100 .11000-11800 CE added 14.4 Lakh in OI so bears added position in range of 11800-12000.FII bought 3.6 K CE long and 1 K shorted CE were covered by them. Retail sold 71.3 K CE and 43.8 K shorted CE were covered by them.

- 11700 PE OI@28.5 Lakhs having the highest OI strong support at 11700 followed by 11600 . 11000-11700 PE liquidated 6.7 Lakh in OI so bulls covered position in range 11600-11700.FII sold 4.7 K PE long and 517 shorted PE were covered by them. Retail bought 134 K PE and 79.5 K PE were shorted by them.

- FII’s bought 1157 cores and DII’s bought 377 cores in cash segment.INR closed at 69.35 Dollar to Rupee Forecast Lok Sabha Election Week

- Nifty Futures Trend Deciding level is 11754 For Intraday Traders). NF Trend Changer Level (Positional Traders) 11872 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11815 Tgt 11840,11867 and 11896 (Nifty Spot Levels)

Sell below 11777 Tgt 11754,11733 and 11710 (Nifty Spot Levels)

Follow on Twitter:https://twitter.com/brahmesh

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ