- FII’s sold 4.3K contract of Index Future worth 464 cores 3.7 K Long contract were covered by FII’s and 661 Short contracts were added by FII’s. Net Open Interest decreased by 3 K contract, so fall in Nifty was used by FII’s to exit long and enter short in Index futures.FII’s Long to Short Ratio at 2.08. How Comfortable you are with your trading ?

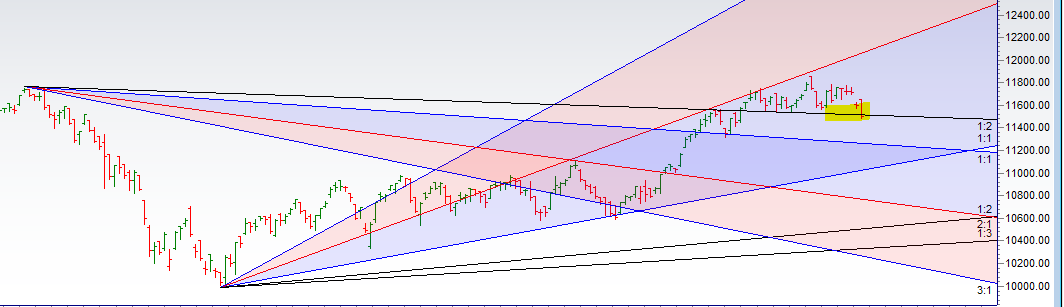

- As Discussed in Last Analysis As we had mercury sign change today as shown in below video, so a good move should be seen. Bulls will get active above 11641 for a move towards 11700/11777/11856. Bears will get active below 11550 for a move towards 11470/11400. Bulls got whipsawed bears got active below 11550 and did 1 target on downside as Mercury Ingress showed its effect. Now fall can extend towards 11400-11376 range where strong support lies.

- Important intraday time for reversal can be at 9:59/11:29/2:48 How to Find and Trade Intraday Reversal Times

- Nifty May Future Open Interest Volume is at 1.89 core with liqudiation of 1.5 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @11742,closed below it.

- Total Future & Option trading volume at 9.81 Lakh core with total contract traded at 1.1 lakh , PCR @0.81

- 12000 CE is having Highest OI at 15.8 Lakh, resistance at 11850 followed by 12000 .11000-11800 CE added 1.5 Lakh in OI so bears added position in range of 11600-11800. FII bought 896 CE and 17.5 K CE were shorted by them. Retail bought 228 K CE and 133 K CE were shorted by them.

- 11500 PE OI@20.8 Lakhs having the highest OI strong support at 11500 followed by 11600 . 11000-11600 PE added 2.3 Lakh in OI so bulls added position in range 11500-11600 .FII bought 16 K PE and 1.2 K PE were shorted by them. Retail sold 28.6 K PE and 104 PE were shorted by them.

- FII’s sold 645 cores and DII’s bought 818 cores in cash segment.INR closed at 69.43 Dollar to Rupee Weekly Analysis

- Nifty Futures Trend Deciding level is 11618 For Intraday Traders). NF Trend Changer Level (Positional Traders) 11742 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11512 Tgt 11535,11555 and 11576 (Nifty Spot Levels)

Sell below 11470 Tgt 11455,11430 and 11400 (Nifty Spot Levels)

Follow on Twitter:https://twitter.com/brahmesh

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ