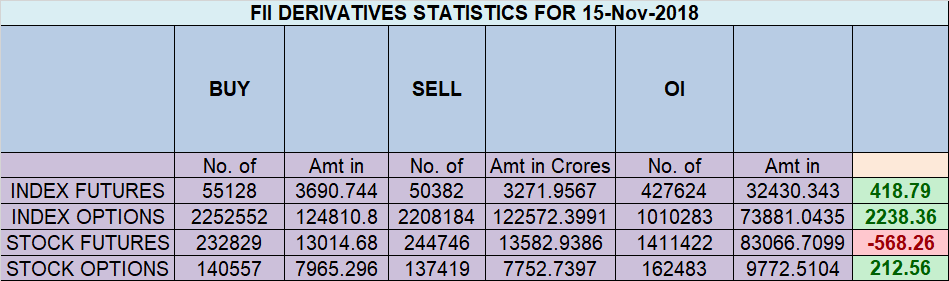

- FII’s bought 4.7 Kcontract of Index Future worth 418 cores ,10 K Long contract were added by FII’s and 5.2 K Short contracts were added by FII’s. Net Open Interest increased by 15.3 K contract, so rie in Nifty was used by FII’s to enter long and enter short in Index futures.FII’s Long to Short Ratio at 0.63. Time Cycle Stock Scanner for 11-16 Nov

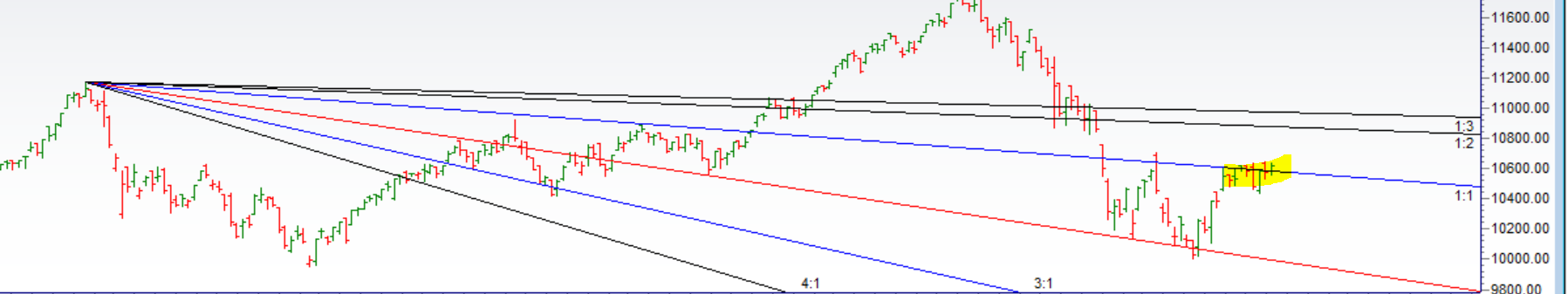

- As Discussed in Last Analysis Another failed attempt to close above 10600 by bulls and low made was 10532 so bears also got whipsawed, Now Nifty is forming a range after a swift rally of 500 points from 10100-10600. As i have discussed before range of 10610-10630 is very imp supply zone as of now Bulls are absorbing the supply but need a close above 10630 for a swift rally till 10710/10777. Bears will get active below 10512 for a move back to 10470/10410. Finally we are able to close above 10600 as today being a Weekly close so closing above 10630 will be bonus for the bulls for the move to continue towards 10712/10777/10856. Bearish below 10570 for a move back towards 10525/10470. Nifty made bottom on 13 Nov as per our time cycle, Now next important date is 18 Nov so effect will be seen on Monday. Important intraday time for reversal can be at 10:12/2:24. Blog Updates have not been regular from past few days as i am on vacation,Blog will be updated from Regular Time from 21 Nov before that updates will not be that regular, I will try my best to Update before market hours. Bank Nifty rallies above Gann Angle,EOD Analysis

- Nifty Nov Future Open Interest Volume is at 2.36 core with liquidation of 0.74 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @10243 closed above it and rallied 400 points

- 10800 CE is having Highest OI at 30.5 Lakh, resistance at 10700 followed by 10800 .10200-10900 CE liquidated 1 lakh in OI so bears covered position in range of 10600-10800. FII bought 2.5 K CE and 443 CE were covered by them. Retail sold 168 K CE and 117 K shorted CE were covered by them.

- 10500 PE OI@26.3 Lakhs having the highest OI strong support at 10500 followed by 10400 . 10000-10700 PE added 12.1 Lakh in OI so bulls added position in range 10400-10500 PE. FII sold 8.8 K PE and 1.9 K PE were shorted by them. Retail sold 152 K PE and 117 K shorted PE were covered by them.

- Total Future & Option trading volume at1 15.60 Lakh core with total contract traded at 1.59 lakh , PCR @0.87

- FII’s bought 2043 cores and DII’s sold 165 cores in cash segment.INR closed at 71.97 Currency Technical: USD INR Weekly Analysis for 05 Nov-09 Nov

- Nifty Futures Trend Deciding level is 10636 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10431. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10645 Tgt 10666,10695 and 10712 (Nifty Spot Levels)

Sell below 10590 Tgt 10570,10555 and 10530 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh