- FII’s bought 7.7 K contract of Index Future worth 702 cores ,9.4 K Long contract were added by FII’s and 1.7 K Short contracts were added by FII’s. Net Open Interest increased by 11.1 K contract, so rise in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 0.92. Volatility is here- Tips For Traders In Volatile Markets

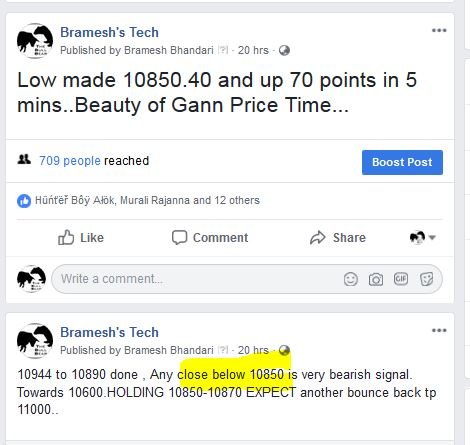

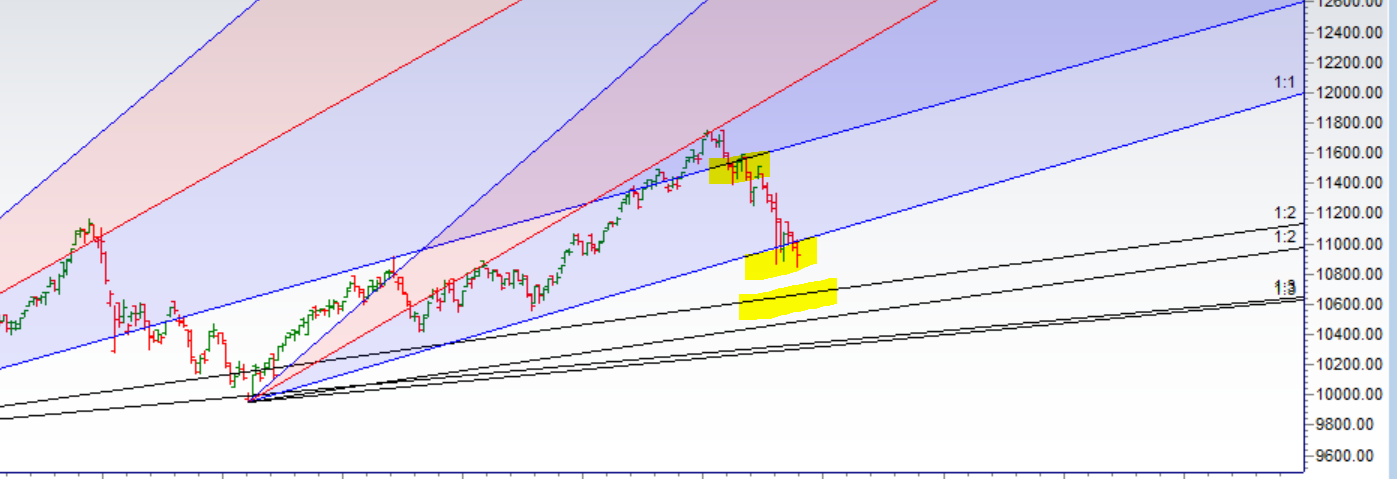

- As Discussed in Last Analysis As Expiry got over yesterday most of the poison is out of system and we are starting Oct Expiry with a very low OI of 1.65 Lakh OI and also as we have Weekly/Monthly/Quarterly so NAV Game will come in Play. Nifty bulls were able to protect 10944 one more time, Bullish above 11006 for a move towards 11089/11149. Bearish below 10944 for a move back to 10890/10830. Nifty again whipsawed us above 11006 , Bearish case worked perfectly and below is my analysis on Facebook during market hours we discussed 10850 i strong support low made was 10850.40 and we rallied 100 points in 10 Mins. Now Bulls need to close above 10944 for a move back to 111030/ 11089/11149. Bearish below 10850 for a move back to 10800/10730/10666. Nifty is bouncing again from the support zone of 10850-10870 our price time squaring level,suggesting its strong support, also closed above last quarterly level of 10930 suggesting we are trying to form bottom. ANy break of 10850 can see fast move towards 10800/10730. Important intraday time for reversal can be at 12:14/2:38. Bank Nifty forms Doji near gann angle,EOD Analysis

- Nifty Oct Future Open Interest Volume is at 1.66 core with addition of 1 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @11075 and Rollover %@ 60.1

- 11200 CE is having Highest OI at 24.3 Lakh, resistance at 11200 followed by 11100 .10800-11300 CE added 13.9 lakh in OI so bears added position in range of 11100-11200. FII sold 6.8 K CE and 14 K CE were shorted by them. Retail bought 75.4 K CE and 39.4 K CE were shorted by them.

- 11000 PE OI@29.3 Lakhs having the highest OI strong support at 10800 followed by 10950 . 10900-11500 PE added 9.1 Lakh in OI so bulls added position in range 10800-11100 PE. FII bought 29.7 K PE and 10.1 K PE were shorted by them. Retail bought 52.9 K PE and 75.2 K PE were shorted by them.

- Total Future & Option trading volume at1 12.29 Lakh core with total contract traded at 1.85 lakh , PCR @0.89

- FII’s sold 1699 cores and DII’s bought 3526 ecores in cash segment.INR closed at 72.61, Started correcting from 72.48 level as discussed in Rupee Analysis. Indian Rupee nearing a Short term top

- Nifty Futures Trend Deciding level is 11005 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 11033. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10940 Tgt 10970,11000 and 11026 (Nifty Spot Levels)

Sell below 10910 Tgt 10885,10860 and 10820 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Nifty is in strong bear phase now. Why are analysing it will bounce and bounce from this level. Why not tell sell at every bounce. 10 min 100 points bounce clearly shows shorts covered. Change the mindset. It will definitely come to 10500 and if it breaks 9800. Stocks are beaten mercilessly. Where is positive. Change the mindset. Like ordinary trader buying in bear phase selling in bull phase.

I will take are of my Mindset Please do not worry !!

have seen all the ups and downs for years. Indian market is very attractive to the saavy(!) ,smarties because it is the biggest satta den of the world .Smarties , a handful of sattabaaz with enormous clout, are making mind boggling money with wild movements fancifully termed irrational exuberance and such terms making a mockery of all studies which are severely handicapped to take into account such large scale manipulated stuff.God save the small fishes trying to decipher the moves and make some paltry money with small capital.I have come across several unemployed youths trying to make a couple of hundred everyday to survive, from stock market playing movements and getting wiped out.