- FII’s sold 3.8 K contract of Index Future worth 391 cores ,4.9 K Long contract were covered by FII’s and 1.1 K Short contracts were covered by FII’s. Net Open Interest decreased by 6.1 K contract, so fall in market was used by FII’s to exit long and exit short in Index futures. FII’s Long to Short Ratio at 0.74. Sneak Peek into Online Trading Summit

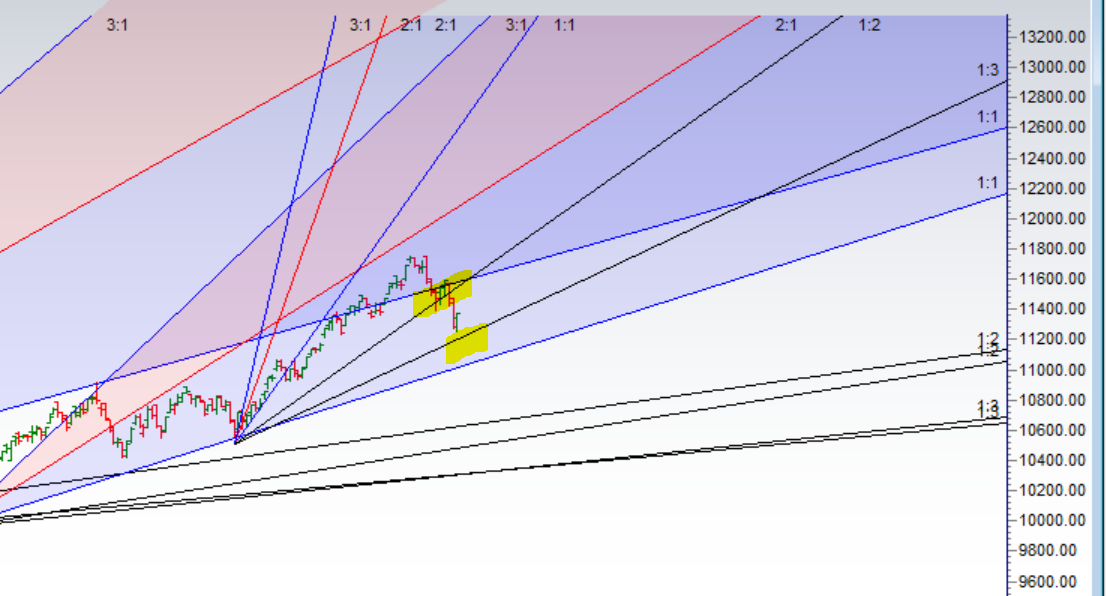

- As Discussed in Last Analysis Time is the 3-D factor in stock market once understood trading gets an additional edge, We were short from 11527 and captured the whole move till 11270, Low made was 11274:). Now any move below 11270 can see fast mvoe towards 11230/11160 where we should get support and see relief rally. Low made was 11250 and we saw the relief rally, Now bulls need a close above 11458 for this up move to continue in case we open gap up tommrow. Bearish below 11350 for a move back to 11280/11230/11159. Bullish above 11458 for a move back to 11520/11570/11630.

- Important intraday time for reversal can be at 11:14/1:49. Bank Nifty Bulls able to close above 26640,EOD Analysis

- Nifty Sep Future Open Interest Volume is at 2.71 core with liquidation of 6 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @11747 and Rollover %@ 67

- 11600 CE is having Highest OI at 36.4 Lakh, resistance at 11400 followed by 11500 .11000-11800 CE liquidated 3.5 lakh in OI so bears covered position in range of 11500-11400 CE. FII bought 3 K CE and 7.2K CE were shorted by them. Retail sold 206 K CE and 126 K shorted CE were covered by them.

- 11200 PE OI@38 Lakhs having the highest OI strong support at 11200 followed by 11100 . 11000-11600 PE liquidated 0.99 Lakh in OI so bulls covered position in range 11300-11400 PE. FII sold 7.1 K PE and 8.2 K shorted PE were covered by them. Retail sold 16.6 K PE and 51.3 K shorted PE were covered by them.

- Total Future & Option trading volume at1 22 Lakh core with total contract traded at 1.57 lakh , PCR @0.76

- FII’s sold 1086 cores and DII’s bought 541 cores in cash segment.INR closed at 72.18. Indian Rupee nearing a Short term top

- Nifty Futures Trend Deciding level is 11361 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 11570. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11420 Tgt 11458,11480 and 11510 (Nifty Spot Levels)

Sell below 11360 Tgt 11333,11300 and 11270 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh