- FII’s sold 12.7 K contract of Index Future worth 1247 cores ,794 Long contract were added by FII’s and 13.5 K Short contracts were added by FII’s. Net Open Interest increased by 14.2 K contract, so fall in market was used by FII’s to exit long and enter short in Index futures. FII’s Long to Short Ratio at 0.56. What is a reasonable objective for a day trader?

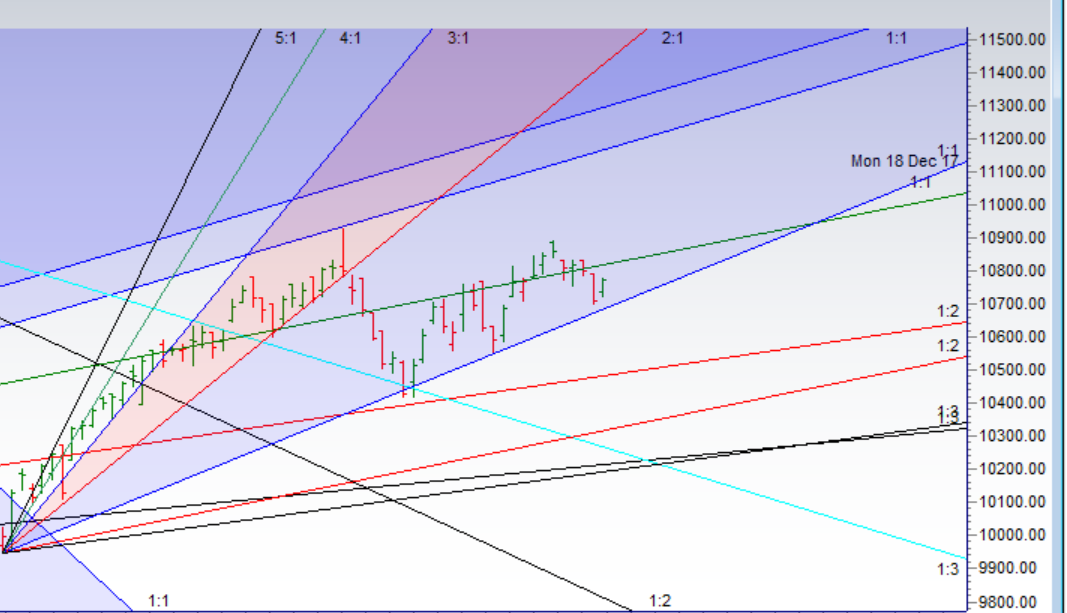

- As Discussed in Last Analysis High made today was 10789 so nifty bears were on frontfoot as we were below 10777 and did 1 target on downside.Below 10700 we can continue to see fall towards 10666/10617 where we have gann angle support, Again time analysis helped in capturing the move as fall came exactly on 19 June. Bullish above 10740 for a move back to 10777/10830. As soon as 10740 was broken bulls push index towards our 1 target of 10777 and waiting for next traget of 10830/10888 till we are holding 10730. Bearish Below 10700 we can continue to see fall towards 10666/10617 where we have gann angle support Important intraday time for reversal can be at 10:07/2:25.Bank Nifty EOD Analysis for 21 June

- Nifty June Future Open Interest Volume is at 2.45 core with liquidation of 1.72 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @10656 closed above it.

- 11000 CE is having Highest OI at 49.6 Lakh, resistance at 10900 followed by 11000 .10300-11000 CE liquidated 14.8 lakh in OI so bears covered position in range of 10800-11000 CE. FII bought 3.7 K CE and 7.7 K shorted CE were covered by them. Retail sold 40 K CE and 2.6 K shorted CE were covered by them.

- 10700 PE OI@53.7 lakhs having the highest OI strong support at 10700 followed by 10600 . 10300-11000 PE added 7.6 Lakh in OI so bulls added position in range 10700-10800 PE. FII bought 4.1 K PE and 494 shorted PE were covered by them. Retail bought 83 K PE and 56.6 K PE were shorted by them.

- Total Future & Option trading volume at 8.87 Lakh core with total contract traded at 1.11 lakh , PCR @1.01

- FII’s sold 2442 cores and DII’s bought 1473 cores in cash segment.INR closed at 68.08

- Nifty Futures Trend Deciding level is 10766 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10742. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10782 Tgt 10800,10820 and 10850 (Nifty Spot Levels)

Sell below 10755 Tgt 10738,10701 and 10680 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh