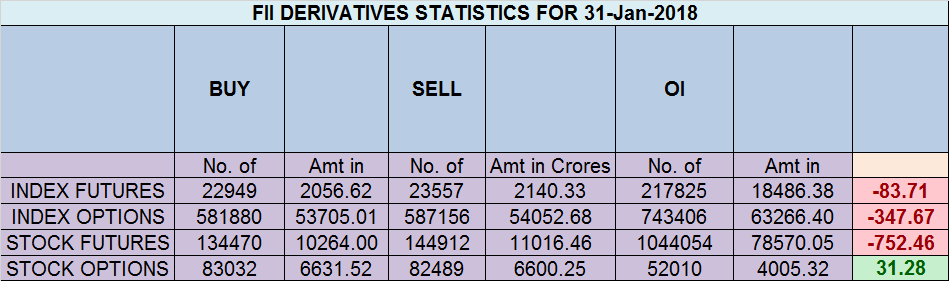

- FII’s sold 608 contract of Index Future worth 83 cores ,663 Long contract were covered by FII’s and 55 Short contracts were covered by FII’s. Net Open Interest decreased by 718 contract, so fall in market was used by FII’s to exit long and eeit short in Index futures. FII’s Long to Short Ratio at 2.3. What not to do on Budget Day Trading

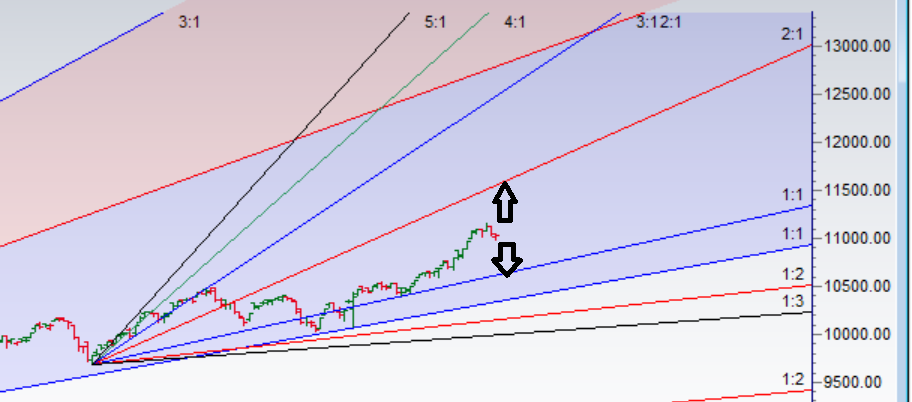

- As Discussed in Last Analysis As seen in below update gann angle chart budget week we can see a swing of 300-400 points , Higher end of gann angle comes at 11498 and low gann angle comes at 10752 so this can be the possible range in coming few days. Bullish above 11100 for a move towards 11170/11265. Bearish below 10996 for a move towards 10900/10792. As we have budget tommrow with loads of volatility.I have mentioned the intraday levels use them for trading. Bulls need a close above 11100 for the uptrend to continue towards 11171/11202/11255/11333/11415,Below 10996 we can see quick fall towards 10886/10782.. Important intraday time for reversal can be at 11/12:30/2:45 Bank Nifty technical setup for Budget day

- Nifty Feb Future Open Interest Volume is at 2.46 core with liquidation of 11.1 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @11048 closed above it.

- Total Future & Option trading volume at 4.73 Lakh core with total contract traded at 1.24 lakh , PCR @0.93

- 11500 CE is having Highest OI at 41 Lakh, resistance at 11400 followed by 11500 .10500-11500 CE added 34 Lakh in OI so bears added position in range of 11400-11500. FII sold 3.6 K CE and 6.5 K CE were shorted by them. Retail bought 105 K CE and 57.2 K CE were shorted by them.

- 11000 PE OI@40.1 lakhs having the highest OI strong support at 11000 followed by 10700 . 10500-11500 PE added 23 Lakh in OI so bulls added position in 10800-11000 PE. FII bought 15.4 K PE and 10.3 K PE were shorted by them. Retail bought 54 K PE and 50.8 K PE were shorted by them.

- FII’s sold 136 cores and DII’s bought 1295 cores in cash segment.INR closed at 63.58

- Nifty Futures Trend Deciding level is 11045 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 11087 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11070 Tgt 11121,11191 and 11259 (Nifty Spot Levels)

Sell below 10980 Tgt 10930,10890 and 10830 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

sir, You had mentioned on 1-1-18 that “TODAY’S Opening and 31-1-18 HIGH is IMPORTANT for this year’s trend”…I have noted those 2 things…Opened @ 10531 [1-1-18]…High @11058 [31-1-18] and MONTH high is 11171…based on this please write an article relating to this year’s trend….

Kumar