- FII’s sold 6 K contract of Index Future worth 369 cores ,962 Long contract were added by FII’s and 5.1 K Short contracts were added by FII’s. Net Open Interest increased by 4.1 K contract, so fall in market was used by FII’s to exit long and enter short in Index futures. FII’s Long to Short Ratio at 1.9, so finally FII’s shorts rewarded them below 10090 What not to do in Bull Market

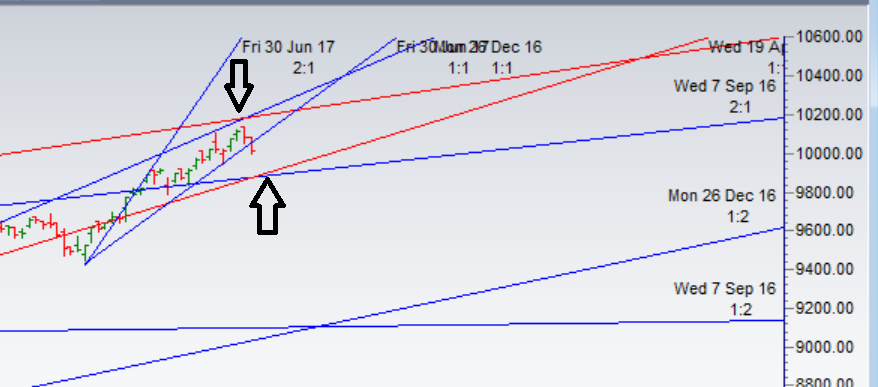

- As discussed in last analysis New Time cycle started today so bulls should hold 10000 for bullish move to continue, break of 10000 bears will become active and push nifty towards 9930/9850. ,as FII have been adding shorts on regular basis and we closed below 10090 bears have slight upperhand over bulls now. Break of 10000 will confirm further correction towards 9930.Big move can be seen in nifty in next 2 days as per time cycle. Low made today was 9998 so bulls continue to hold on to 10000, Also as per our time cycle analysis we got the big move. Bears need to break the time cycle low of 10000 for a move towards 9930.Bulls need close above 10090 for a move towards 10180/10250/10400.Bank Nifty corrects 400 points on Time Cycle pressure date

- Nifty August Future Open Interest Volume is at 2.17 core with addition of 6.9 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @10036 Closed above it.

- Total Future & Option trading volume at 11 Lakh core with total contract traded at 0.88 lakh , PCR @0.89

- 10500 CE is having Highest OI at 41 lakh, resistance at 10500 followed by 10300 .9800-10500 CE added 25.1 Lakh in OI so bears added in range of 10200-10500 CE. FII bought 849 CE longs and 6.4 K CE were shorted by them.Retail sold 82 K CE contracts and 68.9 K shorted CE were covered by them.

- 10000 PE OI@46.2 lakhs having the highest OI strong support at 9900 followed by 10000. 9800-10500 PE liquidated 5 Lakh in OI so bulls liquidated position in 9900-9800 PE. FII bought 11.4 K PE and 5 K PE were shorted by them. Retail sold 100 K PE and 64.3 K shorted PE were covered by them

- FII’s bought 24 cores in Equity and DII’s sold 389 ores in cash segment.INR closed at 63.69

- Nifty Futures Trend Deciding level is 10057 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10084. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10032 Tgt 10050,10065 and 10100(Nifty Spot Levels)

Sell below 10000 Tgt 9980,9950 and 9920 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Amazing Sir .You are the eight wonder of the world when it comes to predictions 🙂

Keep the good work going on Sir .

nothing like that sir.. jsut following the system…