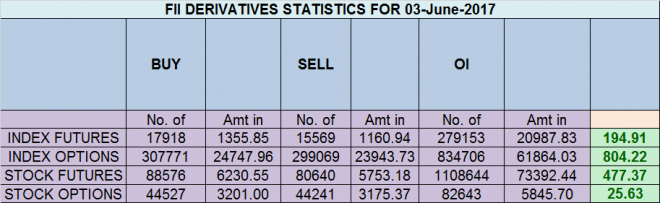

- FII’s bought 2.3 K contract of Index Future worth 194 cores ,1.2 K Long contract were liquidated by FII’s and 3.6 K Short contracts were liquidated by FII’s. Net Open Interest decreased by 4.9 K contract, so rise in market was used by FII’s to exit long and exit short in Index futures. FII’s Long to Short Ratio at 6.2 How Jesse Livermore Described Trading emotions

- As discussed in last analysis Nifty closed above 9610 on Friday and we finally had a gap up opening which did the first target of 9669 now as long as bulls held on to 9610 we can march for higher target of 9700/9779. Bearish below 9580 for a move towards 9520/9470. Nifty continue to make new highs now holding the range of 9640-9648 we are heading towards 9792-9800 range. Bearish below 9600 for a move toward 9530/9480. Bank Nifty make new life highs, holding 23300

- Nifty June Future Open Interest Volume is at 2.21 core with liquidation of 0.28 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @9435 Closed above it.

- Total Future & Option trading volume at 2.46 Lakh core with total contract traded at 0.75 lakh , PCR @1.14

- 9700 CE is having Highest OI at 46.5 lakh, resistance at 9650 followed by 9700 .9300-9800 CE liquidated 4.3 Lakh in OI so bears covered partial position in 9700-9800 CE. FII bought 13.3 K CE longs and 215 shorted CE were covered by them.Retail bought 2.2 K CE contracts and 13.6 K CE were shorted by them.

- 9500 PE OI@64 lakhs having the highest OI strong support at 9500 followed by 9400. 9300-9800 PE added 23.9 Lakh in OI so bulls added aggressively in 9300-9400 PE . FII bought 1.9 K PE and 6.7 K PE were shorted by them. Retail bought 64.5 K PE contracts and 33.4 K PE were shorted by them.

- FII’s bought 476 cores in Equity and DII’s bought 13 cores in cash segment.INR closed at 64.36

- Nifty Futures Trend Deciding level is 9680 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9598. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9674 Tgt 9695,9715 and 9740 (Nifty Spot Levels)

Sell below 9645 Tgt 9615,9600 and 9570(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

sir, I am an avid reader of your blog and find it to be a great tracher. Sir you mention 9700CE has the highest OI, and bears covered their positions , and 9500PEhas highest OI and bulls added aggresivly in 9300/9400PE.

so if bulls are pushing mkt higher and puts are getting wiped out does it mean bulls are taking a hit, and since bears are adding in CALLS, does it mean bears are earning in calls ??

as per my knowledge shuld it not be vice versa ?? plz could you throw some light on it ??

thanks

Thanks Sir..

Bears are covering position as call premium is increasing as market keeps going up..

Bulls are making money as market goes up and PE premium are reducing..