There are three basic steps in spotting Harmonic Price Patterns:

- Step 1: Locate a potential Harmonic Price Pattern

- Step 2: Measure the potential Harmonic Price Pattern

- Step 3: Buy or sell on the completion of the Harmonic Price Pattern

By following these three basic steps, you can find high probability setups that will help you grab good profits.

Let’s see this process in action!

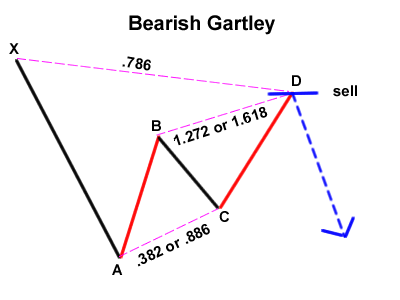

Gartley pattern has the following characteristics:

- Move AB should be the .618 retracement of move XA.

- Move BC should be either .382 or .886 retracement of move AB.

- Move CD should be 1.272 of move BC. if move BC is .786 of move AB, then CD should extend 1.618 of move BC.

- Move CD should be .786 retracement of move XA

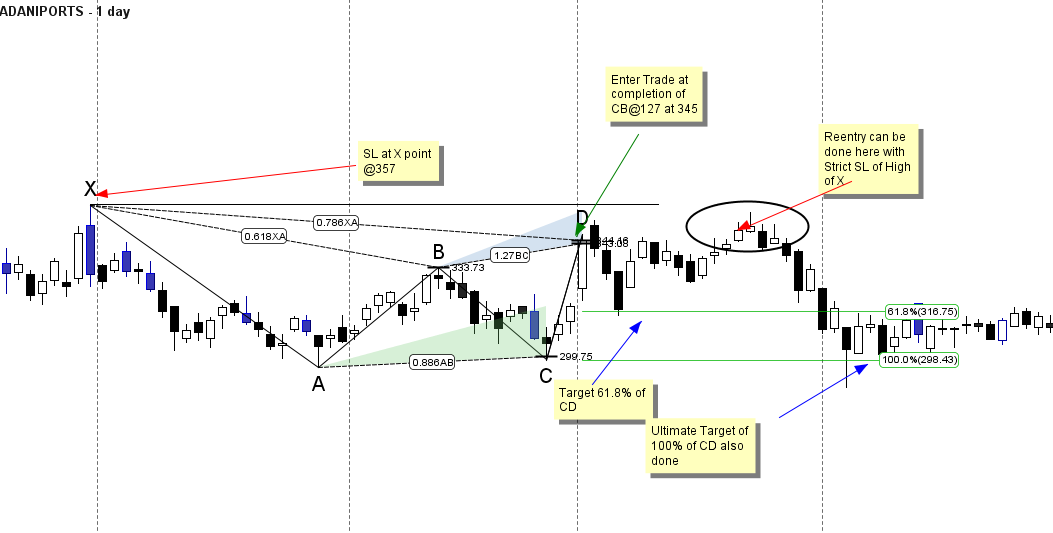

I have shown Daily chart of Adani Ports and marked the potential harmonic pattern in forming

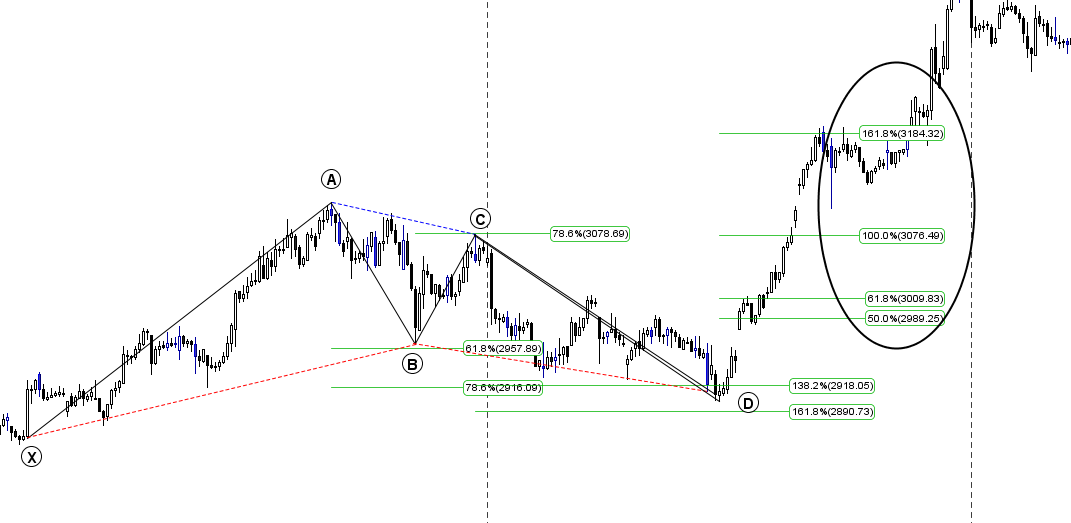

I have shown Daily chart of Hindalco and marked the potential harmonic pattern in forming

I have shown Daily chart of Maruti and marked the potential harmonic pattern in forming

Once the pattern is complete, all you have to do is respond appropriately with a buy or sell order.

This pattern can be hard to spot and once you do, it can get confusing when you apply Fibonacci ratios The key to avoiding all the confusion is to take things one step at a time.

sir,you mentioned BC leg as 0.386 or 0.886. Some people use 0.618.kindly please clarify,thank you

Not really, jamwalr, unless one is looking to trade every turn in prices. Its do-able if your study is based on daily charts, and look for trigger on shorter time from charts.

Hello Bramesh, For Harmonic patterns, which software and data vendor do you use for the Indian Market?

Tks n have a good week

Kush

We use Motivewave and Amibroker..

sir ji..very tough to spot in real time charts….good for academic study only…only a good software can spot such harmonic patterns

Nothing is impossible..We have done this