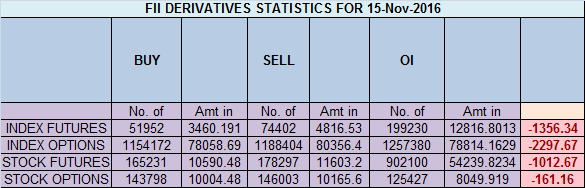

- FII’s sold 22.4 K contract of Index Future worth 1356 cores ,1.5 K Long contract were liquidated by FII’s and 20.9 K short contracts were added by FII’s. Net Open Interest increased by 19.3 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures.

- As discussed in last analysis Nifty opened with gap down and continued with its fall and closed below our important gann number of 8300. Below 8300 Nifty can see quick fall towards 8180/8080. Above 8300 expect another move towards 8400/8556. 8300 is the LOC between Bulls and bears for next week. Nifty opened at 8288 below 8300 quickly sold off low made today was 8093 near our target of 8080. Now again Nifty is at crossroads near gann angle as show in below chart, Range of 8093-8040 is the support range if held we can see fast bounce towards 8448. Bulls will get active above 8188 for a move towards 8270/8410. Bears below 7972 for a mvoe towards 7900/7810. Bank Nifty hold the support zone of 19732,EOD Analysis

- Nifty Nov Future Open Interest Volume is at 1.95 core with addition of 20 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @8705 made high at 8704 on 01 Nov and correction of 700 points.

- Total Future & Option trading volume was at 5 Lakh core with total contract traded at 2.54 lakh , PCR @0.82.

- 8700 CE is having Highest OI at 65 lakh, resistance at 8700 followed by 8500 .8000/8700 CE added 105 lakh so bears added aggressively 8200/8300 PE such aggressive addition suggests emotional selling and market generally react very furiously to give pain to maximum number of traders who join the party late.FII bought 7.9 K CE longs and 38.7 K CE were shorted by them .Retail bought 153 K CE contracts and 54.2 K CE were shorted by them.

- 8000 PE OI@48.2 lakhs having the highest OI strong support at 8000. 8000-8500 PE liquidated 32.3 Lakh in OI so bulls for ran for cover in 8200-8300. FII sold 13.3 K PE longs and 9.9 K shorted PE were covered by them .Retail sold 11.2 K PE contracts and 16.9 K PE were shorted by them.

- FII’s sold 2353 cores in Equity and DII’s sold 104 cores in cash segment.INR closed at 67.75

- Nifty Futures Trend Deciding level is 8188(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8510 . How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8165 Tgt 8190,8211 and 8240 (Nifty Spot Levels)

Sell below 8130 Tgt 8110,8070 and 8040 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Sir. No time study directions? ?

Nope