- FII’s sold 11.6 K contract of Index Future worth 763 cores ,3.6 K Long contract were added by FII’s and 8 K short contracts were added by FII’s. Net Open Interest increased by 4.4 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. Why Do Traders Lose? Part-I

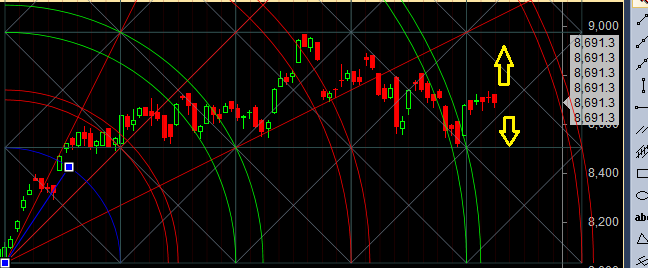

- As discussed last Analysis 8710-8732 is crucial range for bulls as its gann resistance and 8601-8610 is support on downside below which bears will start warming up again. Between the range choppy move continue. High made today was 8722 so bulls were unable to breach the gann resistance zone, Its been 4 trading days in which bulls were not able to break the resistance zone, Low made was 8663 so bears were unable to break 8656. Now bears if they break below 8656 can see fast impulsive fall towards 8600/8555. Bullish only on close above 8750 for a move towards 8840/8900. Lets see which side will give way to other Bank Nifty continue to hold 19700,EOD Analysis

- Nifty Oct Future Open Interest Volume is at 1.40 core with liquidation of 25.6 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8777,corrected 250 points from that

- Total Future & Option trading volume was at 3.76 Lakh core with total contract traded at 1.14 lakh , PCR @1.02 , Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 59.4 lakh, resistance at 8800 .8500/9000 CE added 6.1 lakh so bears added in 8700-8800 range .FII sold 5.4 K CE longs and 3 K CE were shorted by them .Retail bought 33.8 K CE contracts and 15.6 K CE were shorted by them.

- 8600 PE OI@56 lakhs having the highest OI strong support at 8600. 8500-9000 PE liquidated 6.8 Lakh in OI so bulls added ran for cover in 8700-8800 PE as Nifty continue to close below 8750. FII sold 1.6 K PE longs and 2.4 K PE were shorted by them .Retail bought 14.5 K PE contracts and 8 K PE were shorted by them.

- FII’s sold 606 cores in Equity and DII’s bought 389 cores in cash segment.INR closed at 66.89

- Nifty Futures Trend Deciding level is 8690 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8688 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8710 Tgt 8737,8763 and 8789 (Nifty Spot Levels)

Sell below 8680 Tgt 8660,8630 and 8601 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Below are possible reasons-

1. Market may find reasons to move down sensing Trump victory (now it is pretty much unlikely & Hillary win is almost confirm, that will boost the sentiments afterwords)

2. Historically markets were soft in US presidents second term

3. Geopolitical developments are happening at very rapid pace; something may burst very badly.

4. Market data looks like something is fishy; Oct is a small duration expiry & majority of positions were taken well ahead, so liquidation will be more in case of mishap.

5. Banking stress is always sensed & look at dollar index

I deserves the right to be fully wrong, but this is what I am thinking..

Predict and Perish.. Focus on your trading system if you have any.. Traders job is to trade based on his system not to forecast based on some imaginary situation which might or might not happen…

Hemant , please spell out the logic behind your prediction…unless supported by reasons ,it is just useless prediction ,not taken seriously.

Sir what except expire on thusday pl guide.nifty target we may expect 8550

Please read todays analysis

Thanks for your analysis and guidance.

disaster in next two days.. nifty to spell 8200 or below..