The AB=CD or ‘lightning bolt pattern‘ Harmonic Pattern

- AB=CD is a reversal pattern that helps you identify when the price is about to change direction

- AB=CD pattern is a four point harmonic pattern which may be considered the developmental basis for other harmonic patterns.

- A-B leg when a market is trending upwards, the first leg (A-B) is formed as the price rises/fall from A to B.

- B-C leg price switches direction and retraces up/down between 38.2%-78.6% to form the B-C leg.

- C-D leg At point C, the price switches direction again and continues its original uptrend. This leg (C-D) slopes upwards, parallel with the A-B leg and should ideally be the same length as the A-B leg when it completes.

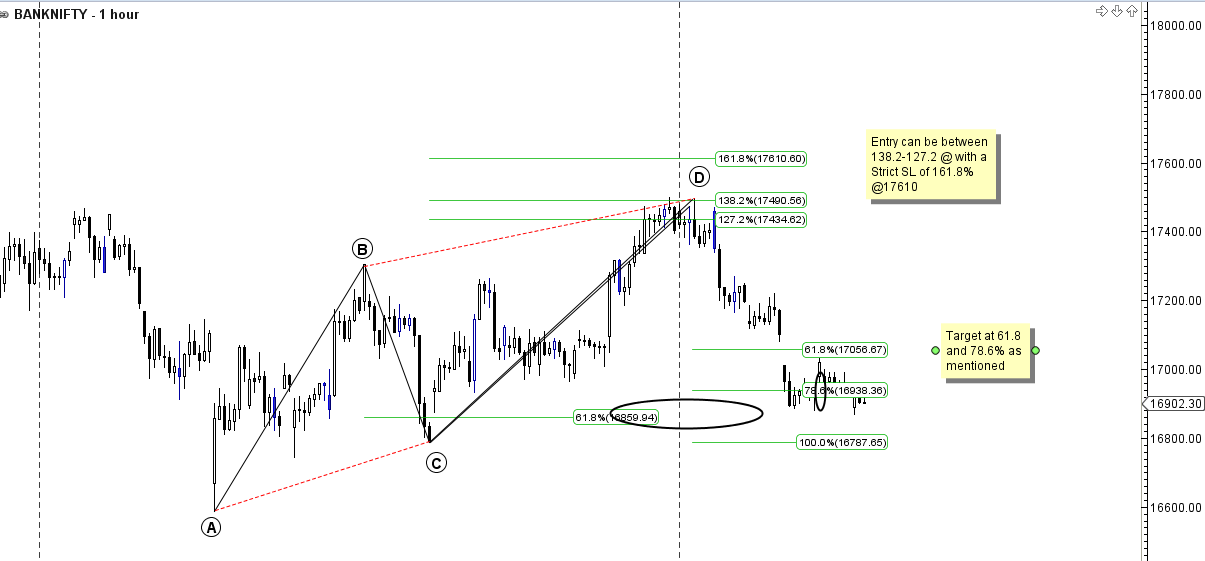

The ideal AB=CD pattern is equal in time and price, with point D being an Fibonacci extension between 127%-161.8% of the B-C leg.

- You can sell at point D (or just before) where the pattern ends, or, in a downtrending market, go long at point D.

- A perfect (hence highly reliable) AB=CD harmonic pattern would have an A-B retracement with a market price differential multiplier of 0.618 and a B-C projection with a market price differential multiplier of 1.618.

Trade Plan with Entry,Exit,SL and Target

- Your entry would be to buy or sell the area where AB=CD

- Your stop loss would be above /below D. Meaning below the high or low that is D.

- For targets, I use 38.2%,50% as Minimal Target and 61.8% of CD leg as Ultimate target .

- Watch closely how the price reacts around the levels. If the price struggles to break through any one of them, then you can close your trade down and take profit early.

- For trailing your stop, you can raise it to a breakeven as soon as the minimal target is achieved

Below are few examples of Better Understanding of ABCD pattern

ABCD in BPCL did target

ABCD in Yes Bank SL Triggred than Did the target

India Bulls Real Estate Daily Chart with Bearish ABCD Pattern

Happy Teachers Day Sirji….

Thanks a lot !!

Your effort is excellent thank u

thanks a lot ~~

Happy Teachers Day Bramesh Sir !

Happy Teacher day sir

Thanks for sharing and making us understand the pattern

Thank you sir for the knowledge shared. What is the time period for one leg of this pattern? Can it be as short as 7-10 days.

Thank You Sir for sharing Harmonic Pattern.

Thanks for sharing Sir..

Thanks for sharing harmonic pattern sir request you that we can get some scanner which can detect which harmonic pattern is there

Thanks 🙂