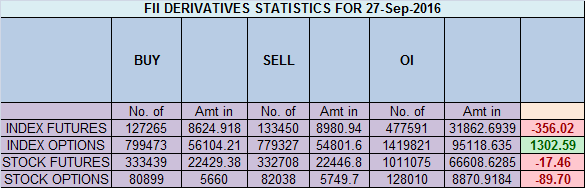

- FII’s sold 6.1 K contract of Index Future worth 356 cores ,9 K Long contract were added by FII’s and 15.2 K short contracts were added by FII’s. Net Open Interest increased by 24.2 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. 3 Mantra of Successful Trading

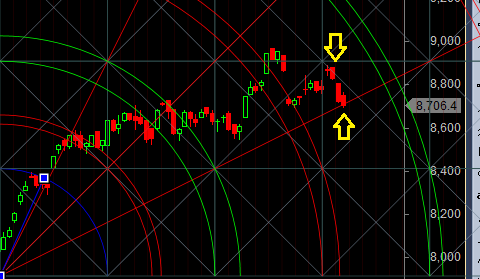

- As discussed last Analysis 8715 low made today and close below 8750 level, suggesting bears have upper hand now can push nifty towards 8675/8650 levels which is extended ABCD pattern target, As we are near gann angle so if we hold on to 8700 tomorrow we can see bounce back till 8787/8806/8832 levels. Close below 8700 can push index towards 8650/8577 levels, exciting expiry coming. Nifty made low of 8690 but closed above 8700, suggesting bulls can see a move till 8787/8806 holding 8700 which is also gann angle support as shown in below chart, bears will get active below 8656 for a move towards 8600/8520. Bank Nifty holds 19500 and gann trendline,EOD Analysis

- Nifty Sep Future Open Interest Volume is at 2.05 core with liquidation of 43.9 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8686, closed above it rallied 250 points.

- Total Future & Option trading volume was at 5.37 Lakh core with total contract traded at 1.87 lakh , PCR @0.94 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 61.7 lakh, resistance at 9000 .8500/9000 CE liquidated 13.8 lakh so bears added aggressively in 8700-8750 CE .FII bought 2.8 K CE longs and 11.8 K CE were shorted by them .Retail bought 29.2 K CE contracts and 16.2 K CE were shorted by them.

- 8500 PE OI@56.5 lakhs having the highest OI strong support at 8500. 8500-9000 PE liquidated 13 Lakh in OI so bulls ran for cover as 8750 level gave in .FII bought 10.4 K PE longs and 18.7 K shorted PE were covered by them .Retail sold 9.4 K PE contracts and 9 K PE were shorted by them.

- FII’s sold 155 cores in Equity and DII’s bought 91 cores in cash segment.INR closed at 66.48

- Nifty Futures Trend Deciding level is 8742 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8805 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8722 Tgt 8753,8770 and 8800 (Nifty Spot Levels)

Sell below 8700 Tgt 8675,8644 and 8600 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Close below 8700 can push index towards 8650/8577 levels,” exciting expiry coming”

sir, can you elaborate what ‘” exciting expiry coming” means ?

market can see good move..