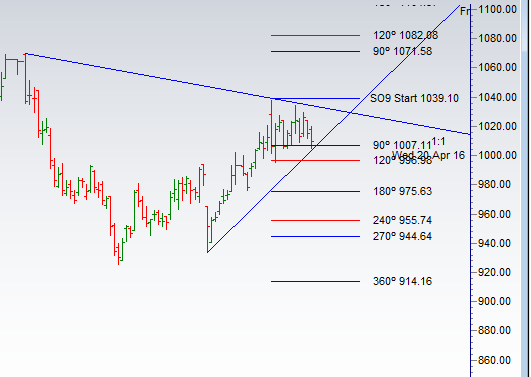

Reliance

Positional Traders can use the below mentioned levels

Close above 1011 Tgt 1042

Intraday Traders can use the below mentioned levels

Buy above 1012 Tgt 1018,1025 and 1032.5 SL 1006

Sell below 1002 Tgt 997,987 and 980 SL 1006

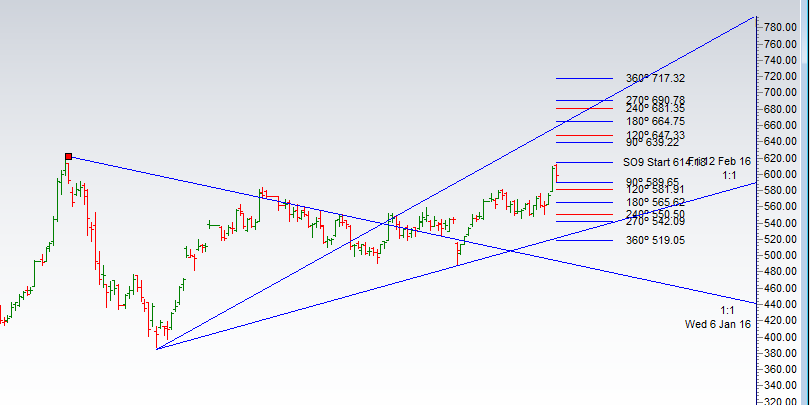

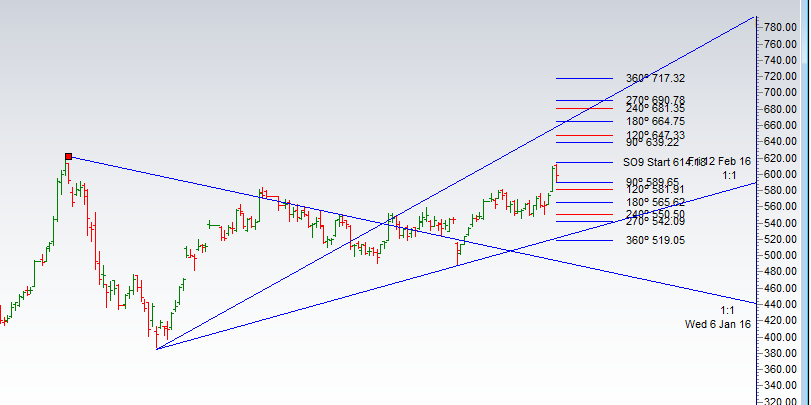

Rel Infra

Positional Traders can use the below mentioned levels

Close above 610 Tgt 623/640/647

Intraday Traders can use the below mentioned levels

Buy above 601 Tgt 610,623 and 632.5 SL 597

Sell below 595 Tgt 588,580 and 570 SL 600

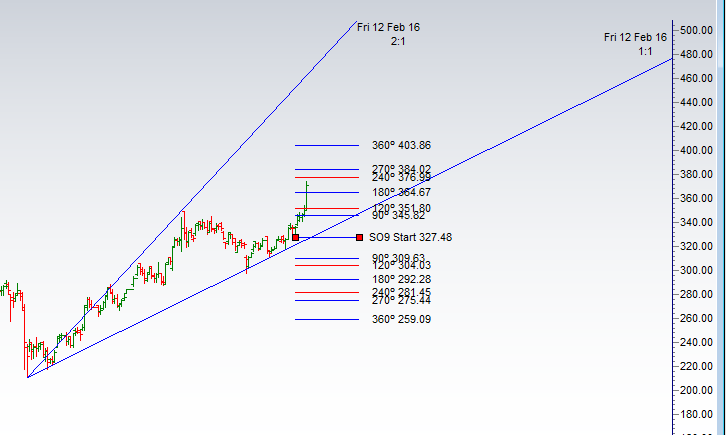

Voltas

Positional Traders can use the below mentioned levels

Close above 377 Tgt 385/390

Intraday Traders can use the below mentioned levels

Buy above 373 Tgt 375,377 and 380.5 SL 371

Sell below 369 Tgt 366,362 and 356 SL 371

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for July Month, Intraday Profit of 3.57 Lakh and Positional Profit of 4.79 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

May I have tech. analysis for BHEL. WHY GOING DOWN?

its in bearish cycle

sir,

I am just started trading while seeking little risk and reward ratio. I started doing EQuity in small qty….Last month’s last week I started trading in and for that week I am at PROFIT.

I remember all your posts maximum and suggestions I follow accordingly.

please explain the following instances…I have noted the intraday trading levels and trade accordingly …I don’t add my feelings or any other suggestions while I trade.

Today I bought VOLTAS @ 373.25 at 9.17 am and SL triggered @ 370.60 at 9.21 am itself…so I got loss

Then at 9.31 am I went SHORT in VOLTAS @ 9.31 am again SL triggered @ 371.15 at 9.40 am

as per your suggestion when 2 SL triggered in a day, then we have to stop trading for that particular day.

I went LONG in RIL @ 1011.60 at 9.27 am, SL not triggered till end, Day High is at 1020 only. closing is > 1011, so I kept the same as DELIVERY and not closed my position…

In FB, you posted VOLTAS as gainer for you, but practically 2 times SL triggered.

what are the precautions I must take..

please explain me How I have to react and learn some lessons or understood the market in these instances…

hope u spare some time to clarify and support me….

thanking you,

regards,

P.T.KUMAR

O=H is same do not Long side trade is clearly mentioned..

But sir how can we know open is the high??can u please elaborate

When first 5 mins high not broken , Like what happened in NS today

Results day always take trade after results are out..