HUL

Positional Traders can use the below mentioned levels

Close below 930 Tgt 898

Intraday Traders can use the below mentioned levels

Buy above 938 Tgt 942,950 and 960 SL 933

Sell below 929 Tgt 925,917 and 912 SL 933

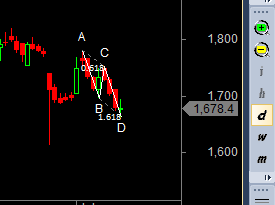

Tata ELXSI

Positional Traders can use the below mentioned levels

Close above 1686 Tgt 1741

Intraday Traders can use the below mentioned levels

Buy above 1680 Tgt 1695,1712 and 1730 SL 1670

Sell below 1660 Tgt 1645,1630 and 1610 SL 1670

NTPC

Positional Traders can use the below mentioned levels

Close below 157 Tgt 152/149

Intraday Traders can use the below mentioned levels

Buy above 159 Tgt 159.6,160.6 and 162 SL 158.2

Sell below 158 Tgt 157.2,155.8 and 154.8 SL 158.5

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for June Month, Intraday Profit of 3.12 Lakh and Positional Profit of 3.08 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

I admire your sincere work in explaining about trading in positional calls.

But if as a conservative trader one had taken a position in M&M which closed below 1453 yesterday he would be a loser today as it is trading above 1453 for one hour today.

But an aggressive trader would have earned if he had gone short yesterday once it had breached 1453 yesterday intraday.

Sir, Why it is so?whether to be conservative or aggresive?

Goal of a trader should be to protect capital.. If you have a small trading account always be conservative trader and protect capital..

Sir SL for positional trader?

Plz read this http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/