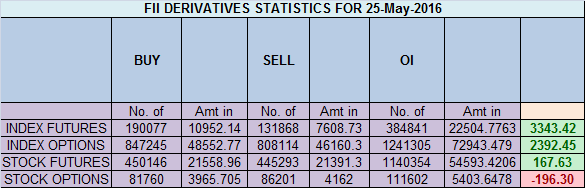

- FII’s bought 58.2 K contract of Index Future worth 3343 cores ,69.9 K Long contract were added by FII’s and 11.7 K short contracts were added by FII’s. Net Open Interest increased by 81.7 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures.Trading Psychology Quotes that can Improve your trading

- As discussed in last analysis Nifty made low of 7716 just tad below 7720 and quickly recovered but still unable to close above 7777, expect impulsive move in next 2 trading session.Break of 7777 can see move above 7834/7860. As per classical TA Market respects support in uptrend and resistance in downtrend, Today was live example, Bulls need a close above 7995 for next move till 8116. Bank Nifty Bulls reacts from gann trendline,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.15 core with liquidation of 21.6 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7953, High made today was also 7949.

- Total Future & Option trading volume was at 6 Lakh core with total contract traded at 2.5 lakh , PCR @0.98, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 78 lakh, resistance at 8000 .7500/8000 CE sold 95 lakh so bears covered today as bulls were able to break 7777/7850 in single session .FII bought 23.4 K CE longs and 31.7 K shorted CE were covered by them .Retail sold 157 K CE contracts and 20.3 K shorted CE were covered by them.

- 7800 PE OI@58.1 lakhs having the highest OI strong support at 7800. 7800-8000 PE added 85 Lakh in OI so strong base near 7800 zone .FII sold 7.6 K PE longs and 8.4 K PE were shorted by them .Retail bought 123 K PE contracts and 5 K shorted PE were covered by them. Retailers bought PE in huge qty so high probability we can see expiry above 8000 tomorrow.

- FII’s bought 495 cores in Equity and DII’s bought 337 cores in cash segment.INR closed at 67.33

- Nifty Futures Trend Deciding level is 7886 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7839 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7980 Tgt 8000,8025 and 8050 (Nifty Spot Levels)

Sell below 7950 Tgt 7930,7915 and 7895 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Brameshji,

really great. two days nifty shot up 300 points

Thanks for the heads up about retailers buying PE.. Works much better than FII buy and sell figures; Kinda feel sorry for my fellow Indians though

I have purchased 7900CE at 145 2 weeks back, after that Nifty did not go up. Today, till now the high was 128. Can i wait till the EOD trading or shall i sell it off now?

What happened Brother, did you wait till EOD or sold it off at a small loss? Just curious.

Morning Bramesh ji,

Haven’t seen such massive CE shorting and PE buying by retailers. Remind me the famous Cramer’s quote on retailer. Kab sudharengey hum 🙂

🙂

Recapping Cramer’s quote….pigs were slaughtered 🙂

perfect input bramesh ji about impulsive move in next 2 trading sessions.