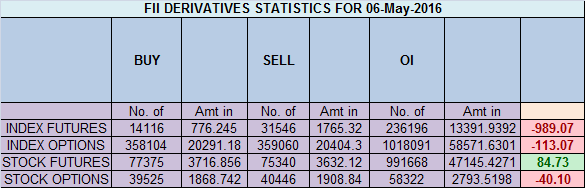

- FII’s sold 17.4 K contract of Index Future worth 989 cores ,11.1 K Long contract were liquidated by FII’s and 6.2 K short contracts were added by FII’s. Net Open Interest decreased by 4.8 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. The Rameswaram BOY who became president

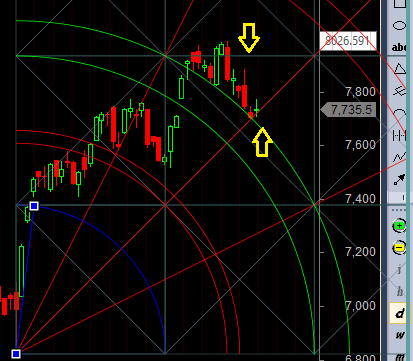

- As discussed in last analysis Nifty made low of 7697 does the target of 7700 near gann support line as shown in below chart, If we hold this line we can see bounce back till 7800/7850 range. High made today was 7738 and low near gann trendline as shown below, if we do not close above 7777 tomorrow it will have bearish implication and Bullish only close above 7850,Expect big move in coming 2 days. Bank Nifty continue to hold gann trendline,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.82 core with liquidation of 0.93 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @7953, continue to trade below it.

- Total Future & Option trading volume was at 1.97 Lakh core with total contract traded at 1.86 lakh , PCR @0.80, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 65.8 lakh, resistance at 8000 .7500/8000 CE added 32 lakh so bears added position on higher level and will hold till nifty do not close above 7850 .FII bought 10 K CE longs and 18.5 K CE were shorted by them .Retail bought 31 K CE contracts and 13.9 K CE were shorted by them.

- 7700 PE OI@44 lakhs having the highest OI strong support at 7700. 7200-7700 PE liquidated 0.72 Lakh in OI so strong base near 7500-7600 zone .FII bought 9.4 K PE longs and 2.3 K PE were shorted by them .Retail bought 15 K PE contracts and 18.2 K PE were shorted by them. FII’s added aggressive Nifty put at start of series, high of 7950 not broken bias remain bearish. High made today 7950

- FII’s sold 388.51 cores in Equity and DII’s bought 251.79 cores in cash segment.INR closed at 66.55

- Nifty Futures Trend Deciding level is 7768 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7840 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7756 Tgt 7777,7797 and 7816 (Nifty Spot Levels)

Sell below 7711 Tgt 7695,7660 and 7640(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Nifty Futures Trend Deciding level should be 7736 ….plz check it !

Level mentioned in correct..

I know the market sentiment is negative but again nifty will make everyone fool. I was going through the charts and after reading it carefully i feel like this is the temporary base for nifty now [ previous runaway gap].

if nifty slips below 7700 then we might see 7600. 7536 should be the bottom of our market , infact after this big downfall also the trend of our maket did not change.Still nifty is in positive trend. One can buy icici by keeping 210 as a stoploss by closing. i am expecting a gap up.

MARKET SENTIMENT MAY BE — VE / NIFTY MAY STILL BE IN +VE TREND

OUR STRATEGY / METHODOLOGY IS TO ATTACK BOTH SIDES — UP AND DOWN

I FEEL REACTIVE TRADERS ARE MORE SUCCESSFUL THAN PREDICTIVE TRADERS

Sirji ,

i think correction reqd “Nifty April Future Open Interest Volume is at 1.82 crore …”

It should be May .

Interesting thing FII are short in index futures but cost of carry and open interest point to closing of short’s …..hmmmmm …thinking…….

thanks corrected…

When there is an increase in price and increase in OI of a particular strike in the option chain.it’s means Long created in call optiion postive…If Particular Put option increase in price and increase in OI.its postive for put or not…pls advise sir

NIFTY 7700 PUT Open Interest 4,443,600 & cHANGE 70,275 ( 1.61 % ) HOW TO READ

Pleas read this http://www.brameshtechanalysis.com/2013/09/volume-and-open-interest-analysis/

7200-7700 PE liquidated 0.72 Lakh in OI…How to read this..It’s bearish sign or bullesh…