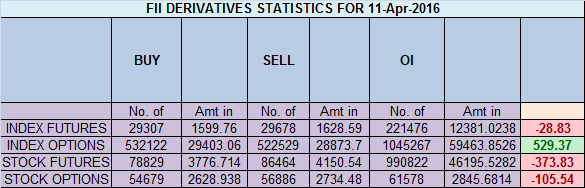

- FII’s sold 371 contract of Index Future worth 28 cores ,685 Long contract were added by FII’s and 1 K short contracts were added by FII’s. Net Open Interest increased by 371 contract, so rise in Nifty market was used by FII’s to enter long and enter shorts in Index futures.Build your Trading Confidence

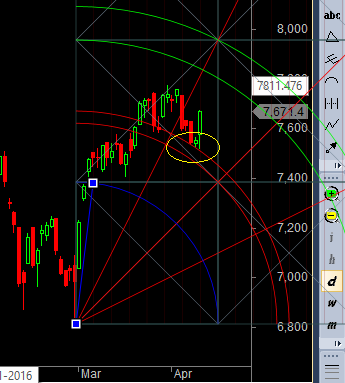

- As we have been discussing Support is near 7546-7519 range and resistance around 7582/7684 so market can swing in both the levels for sometime before making the next major move. Nifty made low of 7516 reacted violently was up 100 points in matter of few minutes effect of gann time analysis, and High of 7670 suggesting Bulls are in firm control. Move above 7684 will see fast move towards 7730/7777. Bank Nifty bounces from gann arc,EOD Analysis

- Nifty April Future Open Interest Volume is at 1.53 core with liquidation of 3.1 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7740, broken it.

- Total Future & Option trading volume was at 2.38 Lakh core with total contract traded at 2 lakh , PCR @0.87, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 84.3 lakh, resistance at 8000 .7500/8000 CE liquidated 17.9 lakh so bears ran for cover as rise was fast and furious .FII sold 1.3 K CE longs and 3.6 K shorted CE were covered by them .Retail sold 43.8 K CE contracts and 18.7 K shorted CE were shorted by them.

- 7500 PE OI@47.4 lakhs having the highest OI strong support at 7500. 7000-7600 PE added 19 Lakh in OI so strong base near 7500 and bulls finally held on into .FII bought 10.5 K PE longs and 3.3 K PE were shorted by them .Retail bought 43.2 K PE contracts and 22.9 K PE were shorted by them.

- FII’s bought 107 cores in Equity and DII’s bought 303 cores in cash segment.INR closed at 66.43

- Nifty Futures Trend Deciding level is 7627 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7676 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7685 Tgt 7720,7745 and 7777 (Nifty Spot Levels)

Sell below 7650 Tgt 7625,7600 and 7565 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

yes as trend changes we need to change coordinates also

Nope its not the right understanding.

One previous coordinate it did all 5 gann arcs so once all 5 arc target done you need to move towards next swing high and low.

Please read gann theory first before coming to any conclusion.

Rgds,

Bramesh

Brameshji, think OI is 1741?

thanks

Hi Bramesh ji, can you please let us know how to trade using trend deciding level (for intraday traders)

Hi Tejaji,

Please read this link http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/

Please tell me importance of Rollover cost

Bullish above it bearish below it

Sirji ,

Crazy move in market , caught bears unaware !!

Can you give the name of book you had suggested for W.D.Gann methods

Was going into old post Any chance you are going to write on Moving avg part 2 or part 3 ?

Got your article on Bollinger Band ,would you be posting on Bollinger Band part2 ?

Also Fibonacci price correction you have written , what about time correction or does it work the same way i mean the time correction ??

RSI indicator pe eak post ho jaye sirji ….

The Law of Vibration: The Revelation of William D. Gann

Will writer the articles as and when i get time.. its on my TO DO list