KSCL

Positional/Swing Traders can use the below mentioned levels

Close above 393 Tgt 398/411

Intraday Traders can use the below mentioned levels

Buy above 393 Tgt 396,400 and 406 SL 390

Sell below 388 Tgt 385,380 and 375 SL 391

IRB

Positional/Swing Traders can use the below mentioned levels

Unable to close above 233 Tgt 225/220/212

Intraday Traders can use the below mentioned levels

Buy above 233.6 Tgt 237,241 and 246 SL 231

Sell below 228 Tgt 225,221 and 216 SL 231

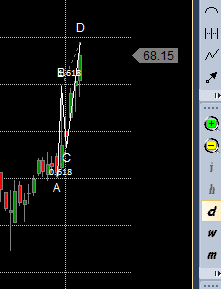

IDBI

Positional/Swing Traders can use the below mentioned levels

Unable t0 close above 69 Tgt 63/60

Intraday Traders can use the below mentioned levels

Buy above 69 Tgt 70,72 and 75 SL 68

Sell below 67 Tgt 65.8,64.6 and 63.6 SL 68

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for February Month, Intraday Profit of 5.09 Lakh and Positional Profit of 2.89 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Sir do you suggest to carry the positional call even if the target for positional call is achieved. KSCL already touched 410. and suppose it closes above 393-395. Can we hold for the target once again?

One Target done trade over for me