- FII’s bought 18.8 K contract of Index Future worth 1030 cores ,18.5 K Long contract were added by FII’s and 342 short contracts were covered by FII’s. Net Open Interest increased by 18.1 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures. What Constitutes 80% Of Trading

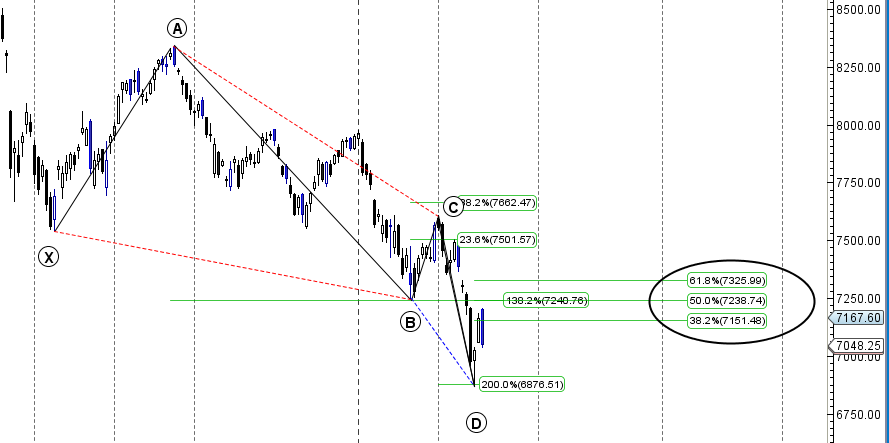

- As discussed in Last Analysis Till 7151 is held on closing basis we are heading towards 7238.Support at 7043. Nifty opened with gap up touched the high of 7204 and fall down to break 7151, and saw the big fall till our support of 7043, closed above it. Till it close above 7043 again we can see move till 7151/7238, below 7043 back to 6950/6900 range. Bank Nifty reacts for supply zone,EOD Analysis

- Nifty February Future Open Interest Volume is at 2.18 core with addition of 7.6 Lakh with increase in cost of carry suggesting long position were added today, Nifty Future closed below the Rollover cost @7419 and gave 500 points profits till now

- Total Future & Option trading volume was at 3.27 Lakh core with total contract traded at 2.2 lakh , PCR @0.80,Today Nifty saw a fall but VIX did not saw any increase, suggesting we can recover tomorrow if 7030 is held .How To Identify Market Tops and Bottom

- 7300 CE OI at 54.8 lakh , wall of resistance @ 7300 .6900/7300 CE added 31.7 lakh in OI addition major addition was seen in 7100/7200 CE .FII sold 1.7 K CE longs and 7.6 K CE were shorted by them .Retail bought 42.7 K CE contracts and 19.3 K CE were shorted by them.

- 7000 PE OI@53.3 lakhs having the highest OI strong support at 6950/7000 . 6900/7300 PE liquidated 6.4 lakh so bulls ran for cover in 7200/7100 PE as Nifty took support at demand zone .FII sold 9.4 K PE longs and 10.9 K PE were shorted by them .Retail bought 3.6 K PE contracts and 14.2 K shorted PE were covered by them.

- FII’s sold 964 cores in Equity and DII’s bought 590 cores in cash segment.INR closed at 68.38

- Nifty Futures Trend Deciding level is 7118 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7340 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7060 Tgt 7095,7120 and 7156 (Nifty Spot Levels)

Sell below 7035 Tgt 7020,6990 and 6950 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

bramesh sir awsome lvl in nifty and banknifty

Sir plz advice on intraday reversal points in index.

Dear Sir,

Could you let me know the importance of ROLLOVER cost @7419 analysis wrt to Major TREND(Down) and the TC levels of 7340

Thanks

PM

OK Thank you Sir.

Keep up your Great work. God Bless you.

Dear Bramesh Sir,

Wanted to know if The TC level is 7340 or 7140 ? As today it was 7208.

Dear Sir,

Its 7340..