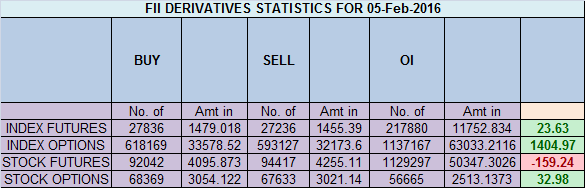

- FII’s bought 600 contract of Index Future worth 23 cores ,4 K Long contract were added by FII’s and 3 K short contracts were added by FII’s. Net Open Interest increased by 7.5 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. How To Improve Trading Success

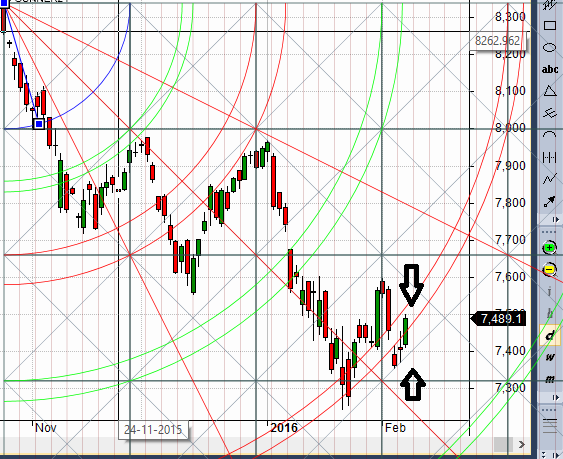

- As discussed in Last Analysis Now we need to see move above gann arc for next round of up move till 7504/7556. Bearish only close below 7360. Nifty made exact high of 7504 near gann arc, Now we need to close above 7504 for next move till 7556. Any close above 7600 on Weekly basis will see change in trend for a bigger swing towards 7970. Support at lower level is 7420/7366 Bank Nifty does Shark Pattern Target,EOD Analysis

- Nifty February Future Open Interest Volume is at 1.84 core with liquidation of 4.2 Lakh with increase in cost of carry suggesting short position were closed today, Nifty Future closed above the Rollover cost @7419 and again gave 100 points on upside.

- Total Future & Option trading volume was at 2.31 Lakh core with total contract traded at 1.7 lakh , PCR @0.85 .How To Identify Market Tops and Bottom

- 7600 CE OI at 56 lakh , wall of resistance @ 7600 .7400/8000 CE added 4.5 lakh in OI addition was seen by bears major addition was seen in 7800/7900 CE .FII bought 21.6 K CE longs and 0.04 K shorted CE were covered by them .Retail sold 28.7 K CE contracts and 9.5 K CE were shorted by them.

- 7400 PE OI@52.2 lakhs having the highest OI strong support at 7400 . 7300/8000 PE added 22 lakh so bulls added in aggressive manner as nifty closed above 7366 .FII bought 10.5 K PE longs and 7.6 K PE were shorted by them .Retail bought 28.8 K PE contracts and 17.1 K PE were shorted by them.

- FII’s sold 606 cores in Equity and DII’s bought 760 cores in cash segment.INR closed at 67.65

- Nifty Futures Trend Deciding level is 7487 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7485 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7505 Tgt 7525,7560 and 7600 (Nifty Spot Levels)

Sell below 7460 Tgt 7430,7400 and 7370 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir what does this mean:FII bought 21.6 K CE longs and 0.04 K shorted CE were covered by them .Retail sold 28.7 K CE contracts and 9.5 K CE were shorted by them.

does it mean FII brought normal option calls and retailers sold them the corresponding option calls .If yes ,Isnt that normally the other way around as FII’s are considered smarter than retailers.

In Trading trader who follow the rule of the game will take money from other. Be its FII/Retail both will make money if they follow their rules, one who do not follow tend out to be loser