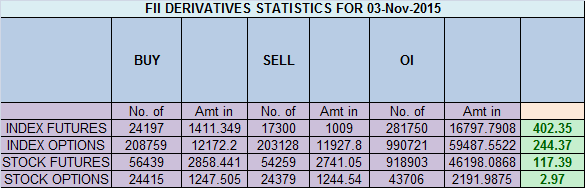

- FII’s bought 6.8 K contract of Index Future worth 402 cores ,3.3 K Long contract were added by FII’s and 3.5 K short contracts were liquidated by FII’s. Net Open Interest decreased by 117 contract, so today’s rise/fall in market was used by FII’s to enter long and exit shorts in Index futures How to Prepare Successful Trading Plan

- Nifty after 5 days of correction of 340 points,finally saw some green on the screen but still unable to close above 8088 and gann arc. Support below 8008 comes at 7930 so these level should be watched on downside,Nifty needs to close above 8088 for bounceback till 8128/8209. Bank Nifty unable to close above supply zone,EOD Analysis

- Nifty November Future Open Interest Volume is at 1.9 core with addition of 0.59 Lakh with decrease in CoC suggesting short position were added today.NF closed below the Rollover cost @8294

- Total Future & Option trading volume was at 1.30 Lakh core with total contract traded at 1.09 lakh so increase in lot size showing effect on volumes, PCR @0.81. Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8500 CE OI at 37 lakh , wall of resistance @ 8500 .8100/8400 CE added 7.3 lakh in OI so bears adding position at higher levels.FII bought 11.7 K CE longs and 13.9 K CE were shorted by them.Retail bought 10.7 K CE contracts and 13.2 K CE were shorted by them.

- 7800 PE OI@ 37.8 lakhs strong base @ 7800, base is coming down from past 2 trading session. 7500/7900 PE added 11.4 lakh so bulls are also building up position eventhough nifty is not able to sustain higher levels almost 81 lakhs added in 3 days which will be tested by friday is it weak bulls or strong bulls are adding position.FII bought 15.7 K PE longs and 7.9 K PE were shorted by them .Retail bought 15.3 K PE contracts and 15.5 K PE were shorted by them.FII going with bearish bias from start of series.

- FII’s sold 449 cores in Equity and DII’s bought 350 cores in cash segment.INR closed at 65.63.

- Nifty Futures Trend Deciding level is 8096 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8111 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8070 Tgt 8095,8130 and 8165 (Nifty Spot Levels)

Sell below 8030 Tgt 8010,7972 and 7945 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Hello.. Can anyone suggest me.. How-to calculate.. Rollover cost..

its covered in my trading course

from the past 5 days its been sell on rise market, Bihar effect is taking market down…i don’t think 8000 will be taken down easily at least before exit polls…