- FII’s bought 20.3 K contract of Index Future worth 458 cores ,22.4 K Long contract were added by FII’s and 2.1 K short contracts were added by FII’s. Net Open Interest increased by 24.5 K contract, so today’s rise in market was used by FII’s to enter long and enter shorts in Index futures Offense and Defense in Trading

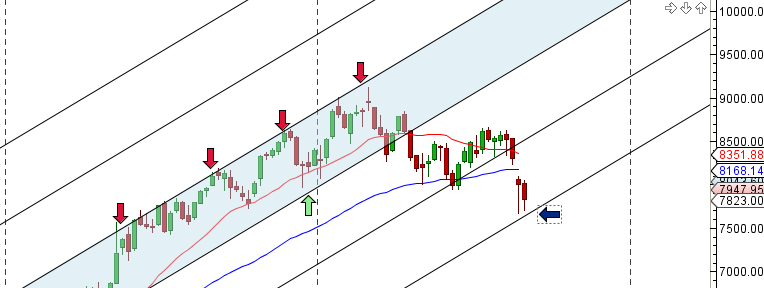

- We have been discussing in previous analysis Nifty continued with its fall and is tad below the swing low of 7767. Nifty is now entering the demand zone of 7663 holding the same we can see sharp bounceback, unable to close above 7663 on weekly basis can see nifty going all the way down to 7422 levels. Nifty is again near Weekly support line will it lead to bounce ? We got the expected bounce and now need to close above 7897 for a move towards 7930/7971.

- Nifty September Future Open Interest Volume is at 2.26 core with liquidation of 0.92 Lakh with fall in OI and decrease in CoC suggesting long position have been liquidated . Rollover stand at 65 % and avg cost of rollover @ 7998.

- Total Future & Option trading volume was at 1.68 Lakh core with total contract traded at 6.9 lakh . PCR @0.92.

- 8200 CE OI at 44.6 lakh , wall of resistance @ 8200 .7900/8200 CE added 10 lakh in OI so bears added major position today in 8100/8200 CE and added 63 Lakh. FII bought 33 K CE longs and 112 K CE were shorted by them.Retail bought 10 K CE contracts and 6.1 K shorted CE were covered by them.

- 7800 PE OI@ 46 lakhs strong base @ 7800. 7900/8100 PE added 0.84 lakh so no major addition was seen by bulls with a 80 point rise. FII bought 109 K PE longs and 12.6 K PE were shorted by them.Retail bought 16.2 K PE contracts and 39.9 K PE contracts were shorted by them. As VIX has reduced so Call/PUT options premium were reduced drastically so even with 100 point rise OTM call options were trading negative.

- FII’s sold 394 cores in Equity and DII’s bought 840 cores in cash segment.INR closed at 66.24 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7820 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7913 and BNF Trend Deciding Level 16516 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 16940 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7862 Tgt 7900,7930 and 7955 (Nifty Spot Levels)

Sell below 7805 Tgt 7770,7750 and 7720 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

today’s analysis was amazing. i got 100 % today.

i have one doubt.

Suppose, a trend changing pivot is triggered with a decrease in OI. Does that mean, people are losing confidence in the trend and that makes the trend change more trustworthy?? Or, as the OI is decreasing which means people are not taking any positions in the new trend , hence its better to wait for the confirmation?

bramesh sir,

Looking at the FII FNO figures for the last few days. It seems market is behaving exactly opposite to the positions FIIs are making every day. They must be heavily in loss based on these figures.

Their numbers only seem to make sense intraday, but where they are only coverign or building new positions. Not able to reap the fruits of those positions.

FII are shorts buying PE everyday and TC level in short, both FII and Blog readers are on right side of trend.

Rgds,

Bramesh

Oh thanks. Must have misread data.

Thanks for clarifying.

Hi Bramesh,

Please provide the BUY & SELL level for banknifty also.