- FII’s bought 20.2 K contract of Index Future worth 397 cores ,23.1 K Long contract were added by FII’s and 2.8 K short contracts were added by FII’s. Net Open Interest increased by 25.9 K contract, so today’s rise was used by FII’s to enter longs in index futures Overcoming Emotions As A Day Trader

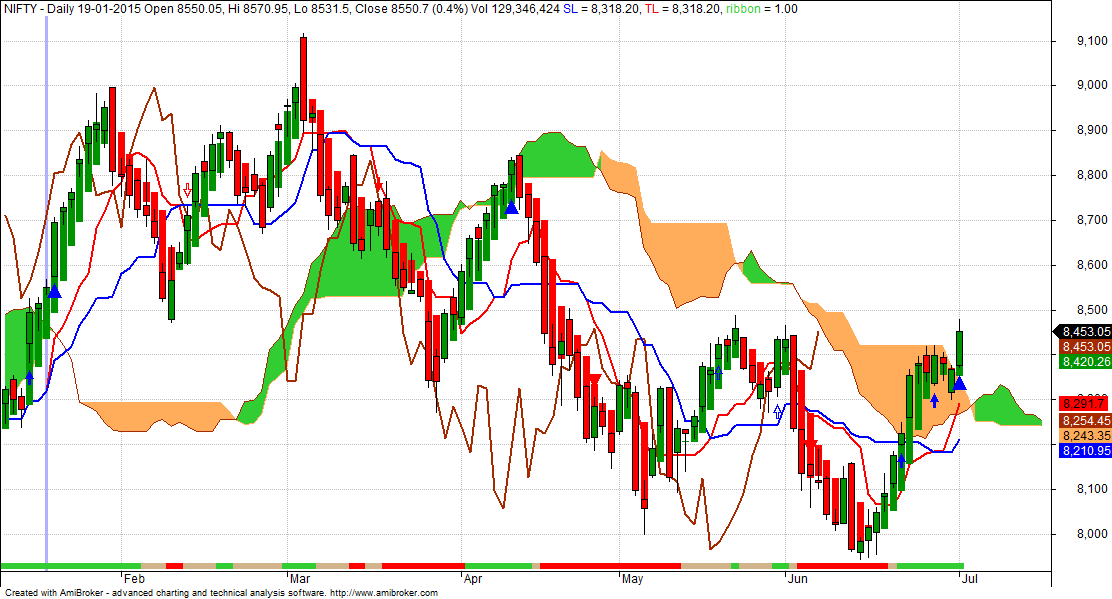

- As discussed yesterday Nifty is entering the new quadrant as per gunner so there is high probability of 8423 breaking and heading towards 8470 which is near 1*2 gann line. Higher High Higher low formation are forming uptrend continues. Strong support at 8300 zone below than 8250. Nifty made high of 8481 around 100 DMA, and gann 1*2 line and closing above the same can see move till 8524/8619.Strong support at 8398/8370 zone. Ichimoku Kinko Hyo has also shown breakout on daily chart as shown below.

- Nifty July Future Open Interest Volume is at 1.70 core with addition of 6.9 Lakh, with decrease in CoC suggesting longs have exited out of system today.NF Rollover range @8357 should be kept close eye on,holding below bears are in control above it bulls have upper hand.

- Total Future & Option trading volume was at 1.75 core with total contract traded at 4.5 lakh. PCR @1.07

- 8500 CE OI at 33.4 lakh , wall of resistance @ 8500 .8000/8500 CE liquidated 6.5 lakh so bears liquidated positions and just holding 10 lakhs overall. FII bought 43.3 K CE longs and 14.8 K CE were shorted by them.Retail bought 0.09 K CE contracts.

- 8000 PE OI@ 57.5 lakhs so strong base @ 8000. 7900/8500 PE added 22.6 lakh so bulls added aggressively today and have added 56 lakh suggesting bulls are still in control of market . FII bought 23.4 K PE longs and 15.7 K PE were shorted by them.Retail bought 88.1 lakh PE contracts. SO again retailers going long in PE and market rising.

- FII’s bought 75 cores in Equity and DII’s bought 52 cores in cash segment.INR closed at 63.6

- Nifty Futures Trend Deciding level is 8430 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8362 and BNF Trend Deciding Level 18424 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18275 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8480 Tgt 8500,8524 and 8550 (Nifty Spot Levels)

Sell below 8430 Tgt 8400,8388 and 8350 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

durairajan said:

according to mm bank nifty spot is at the 4/8 support and resistence zone of 18750 and also immedieate res is 18672 spot .now its looking down to 3/8 top of trading range –18437 ..if not sustain at 18437 then next target 1/8 weak stall and reverse 17812 is the supporting area.from 17812 its shoots upoto 19062 before monsoon session.thanks–did exactly and taken support at 17812 bnf and now friday (3.7.15)closing 18750.

June 29, 2015 .

“Nifty breaks above ichimoku cloud” what does it mean?

What about the negative time cycle, will it close below 8380 on Friday ? or the time cycle analysis will prove wrong ?

Yup, got it ! Thanks!

Mr. Bramesh,

i have a doubt. You have mentioned above that today’s rise was used by FIIs’ to enter longs in index fut., while below it has been mentioned that coc is negitive suggesting today’s rise was used for longs to exit from the system A little bit confused on that part. Please clarify.

Coc is for OI which is mix of retails/fii/propritery traders.

Its not for FII alone

Red arc in yesterday’s review became green arc in today’s ??

No its red arc only, update the chart.

Bank nifty intraday level ??..seems some typing error

Banking stocks outperformed, helping the Bank Nifty to end above the crucial level of 18500. Looking at the option set-up, we believe that the continuance of this trend is likely to take the index towards 18700-18900 in the coming days. Buy Bank Nifty in the range of 18400-18440, targets: 18520- 18650, stop loss: 18320

Excellent at par like always