LT

Holding 1686 stock is heading to 1741,1788.

Intraday Traders can use the below mentioned levels

Buy above 1709 Tgt 1725,1741 and 1762 SL 1705

Sell below 1700 Tgt 1685,1662 and 1643 SL 1705

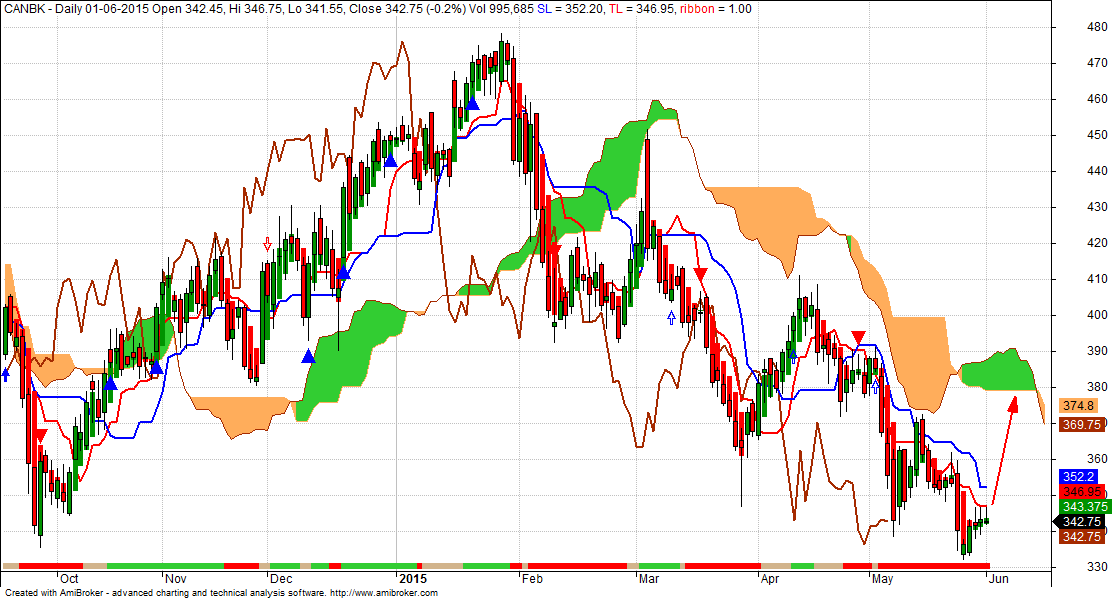

Canara Bank

Any close above 344 short term target 356/364.

Intraday Traders can use the below mentioned levels

Buy above 344 Tgt 345.8,348 and 351 SL 342

Sell below 340 Tgt 338.5,335 and 330 SL 342

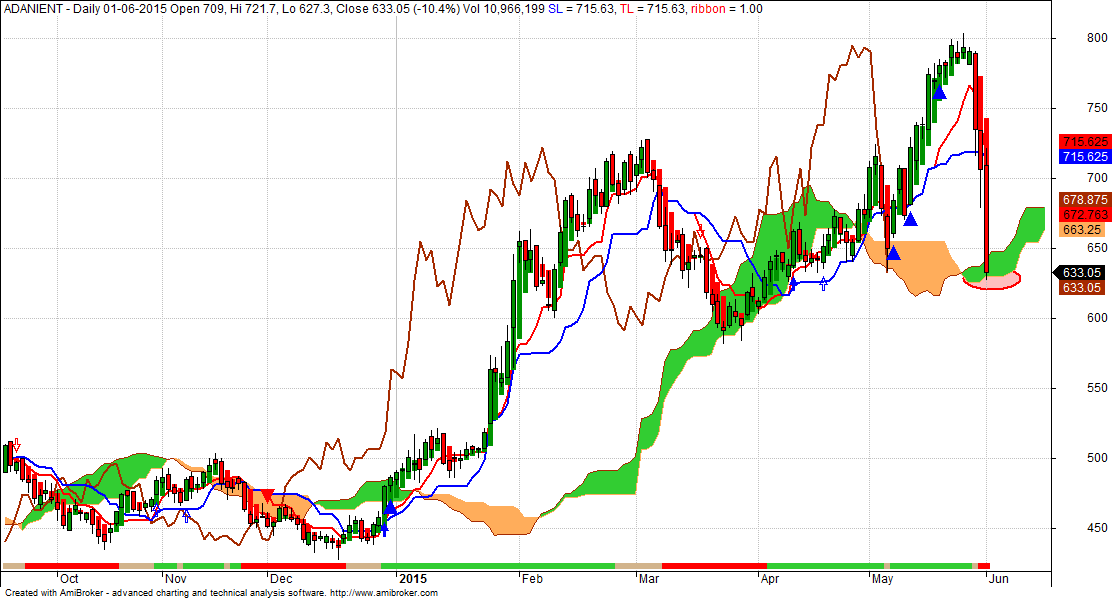

Adani

Any close above 644 short term target 665/699.

Intraday Traders can use the below mentioned levels

Buy above 636 Tgt 644,650 and 660 SL 630

Sell below 627 Tgt 620,610 and 597 SL 633

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for May Month, Intraday Profit of 2.32 Lakh and Positional Profit of 2.07Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Chikou is the heart and secret of ichimoku chart. you are not referring anywhere.Anyway your choice.

I was amazed so see Canbank arrow? can you plz explain why this arrow was drawn , i mean what method of ichimoku was used by you for this?

hi sir can you explain how u r calculating the profit loss in LT on 2nd june, it has trigeered twice buy side and one time on sell side. and before achiving the 2nd tgt on sell side it has come to buy side then it hit 2nd tgt so how we can say that 2nd tgt in sell hit. please explain

Traders were taken after noise was out of market ie. after RBI policy.

Hi Bramesh…Are the positional calls applicable only for the trading day? When you say “Any close above 644 short term target 665/699”, does it mean close above 644 on any day in future can be taken as a trigger to buy? Or is it specifically for June 2nd?

Its a positional call can be taken any day in series.

Thanks for clarifying 🙂

Welcome 🙂

Thank you sir

for ichimokku what are the settings you are using

Default settings