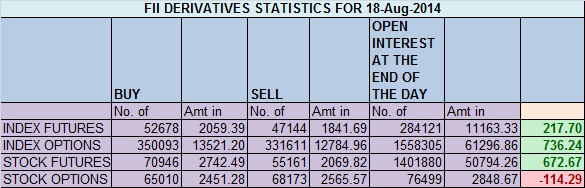

- FII’s bought 5534 contract of Index Future worth 217 cores, 6.9 K Long contract were added and 1.4 K short contracts were added by FII’s. Net Open Interest increased by 5.5 K contract , so FII are going both long and short in Index Future.

- Nifty did a fresh life high today @ 7881, but the high was backed with lowest volume in past 15 days, also no premium in NF indicates new high was just backed by short covering. Nifty is trading in uncharted territory 7896 and 7945 are 2 numbers to keep a watch on.

- Nifty Future Aug Open Interest Volume is at 1.50 cores with addition of 6.4 lakh suggesting long addition with CoC almost coming in negative suggesting premium erosion in nF . VIX being very low suggests bulls are still overconfident and every dip is getting bought into.

- Total Future & Option trading volume was at 2.03 lakh core with total contract traded at 1.8 lakh. PCR @1.06.

- 8000 CE OI at 72.8 lakh suggesting wall of resistance , 7800 CE liquidated 8.7 lakh suggesting bears got panicked today .7700/7600 CE saw 7.6 lakh liquidation so bears are losing there ground . FII’s bought 32 K CE longs and 2.9 K CE were shorted by them.

- 7700 PE OI@ 72.3lakhs so strong base @ 7700. 7800 PE added 20 lakh addition in OI, suggesting bulls are all over support @ 7800, Break of 7800 can bring panic in bull camp .FII’s bought 11.5 K contract PE longs and 22.1 K PE were shorted by them.

- FIIs bought 473 cores in Equity and DII bought 490 cores in cash segment.INR closed at 60.76

- Nifty Futures Trend Deciding level is 7844 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7715 and BNF Trend Changer Level (Positional Traders) 15150 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7881 Tgt 7910,7945 and 8011 (Nifty Spot Levels)

Sell below 7844 Tgt 7810, 7780 and 7744 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

How do you derived data that suggest what FII added long open interest or short open interest. can you please elaborate and many would appreciate it.

Please suggest how to get an excel file to calculate these.

regards

Hello Bhanu,

Its covered in my trading course.

Rgds,

Bramesh

I am extremely conversant in technical analyses but surely interested in understanding technicals of Options and understanding futures data like analyzing open interest addition and squaring up etc. would you do that and please send me details. Duration and mode of training and fee etc.

thanks. I am going to call you now

how can peaple make profit in tradeing ..plzz help me sir

sir i ama poor student..plz tell me some bank nifty statergy so that i canm make 20-30 point sothat i can contnue my study..help me plz sir..email – mrsatyabbsr@gmail.com

Dear Satya,

My Only advise to you is stop trading and concentrate on your studies. Try to get some other Job which can fund your education. Trading is strict No NO

Rgds,

Bramesh

sir where you get Fii data upto date,i have searched it in SEBI site i got only previous day data(14.08.2014)

NSE INDIA

Rgds,

Bramesh

HOW TO ENLARGE TO VIEW DIFFERENT LEVELS MENTION IN CHARTS POSTED BY YOU.

sir please enable right click and copying the content. as i daily copy all calls and nifty in an excel sheet for a record for positional trading. kindly enable it.

You can manually enter the call in your excel.

Rgds,

Bramesh

Sir can nifty test 7600 till aug expiry??

7700 is quiet possible as of now.

Rgds,

Bramesh

Thank you sir. I really like your daily views. You are a real gem for retail market imvestors. Hats off to you sir!! 🙂

thanks for analysis, really appreciate it…

right click on charts is not working…. plz fix that if possible

Its fixed

Rgds,

Bramesh