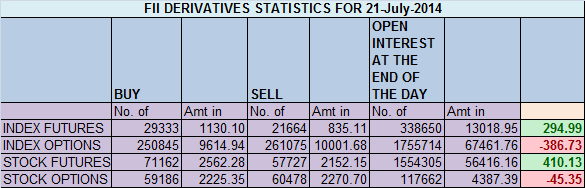

- FII’s bought 7669 contract of Index Future worth 295 cores, 2.8 K Long contract were added and 4.7 K short contracts were squared off by FII’s. Net Open Interest came down by 1.9 K contract.So FII’s used today’s rise to exit the shorts and enter long positions.

- Nifty has been rising from past 5 trading session,all of the 5 days have opened with gap. 7700 above range has becomes a strong supply zone and Budget day high of 7731 should be watched closely.

Nifty is forming rising wedge pattern on hourly charts,break of 7674 can see fall till 7610 odd levels.

- Nifty Future July Open Interest Volume is at 1.50 cores with liquidation of 1.3K suggesting no major position change.

- Total Future & Option trading volume was at 1.71 lakh core with total contract traded at 1.57 lakh. PCR @0.98.

- 8000 CE OI at 83 lakh suggesting wall of resistance , 7800/7900 CE saw 8.2 lakh addition suggesting Bears are building wall of resistance @ 7800 ,FII’s bought 6.7 K CE longs and 10.7 K s CE were shorted by them.

- 7500 PE OI at 68.3 lakh saw addition of 0.1 lakh so strong support of 7500 , 7600 PE also added 9.8 lakhs .FII’s sold 6.1 K PE longs and 83 PE were shorted by them.

- FIIs bought 161 cores in Equity and DII sold 181 cores in cash segment.INR closed at 60.29.

- Nifty Futures Trend Deciding level is 7697 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7636 and BNF Trend Changer Level (Positional Traders) 15225 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7694 Tgt 7712,7731 and 7760 (Nifty Spot Levels)

Sell below 7664 Tgt 7645, 7616 and 7573 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates