- FII’s bought 187 contract of Index Futures worth 15 cores (2.1 K longs were added and 1.9 K shorts were added in Index Future) with net OI increasing by 4.1 K contracts.FII’s playing for range bound moves till expiry.

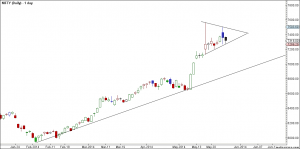

- Nifty is forming a triangle on daily charts, height of triangle comes at 434 points. Now to complete the triangle formation market has to give one rally on upside near 7380-7400 zone. Triangle patterns success is around 50% so do caution is advised.

- Nifty Future May Open Interest Volume is at 1.66 cores with liquidation of of 25.1 lakhs in Open Interest, suggesting long liquidation.20 lakhs got rollovered to June series.

- Total Future & Option trading volume at 2.65 lakh core with total contract traded at 2.8 lakh.PCR @0.82

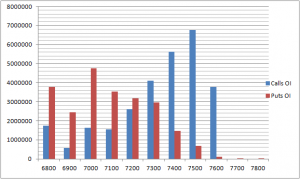

- 7500 Nifty CE is having highest OI at 67.6 lakhs followed by 7400 CE ,7400 CE is also having an OI of 50 lakhs and it seems smart money is selling 7400 CE. FII’s sold 13.3 K CE longs and 18.1 K shorted CE were covered by them.

- 7000 PE is having highest OI at 45.8 lakh remains a strong support for the series. 7400 PE saw a good addition are upcoming support of the market. FII’s sold 1.8 K PE longs and 9.7 K PE were shorted by them.

- FIIs sold 202 cores in Equity and DII sold 95 cores in cash segment.INR closed above 59.03.

- Nifty Futures Trend Deciding level is 7420 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7027 and BNF Trend Changer Level (Positional Traders) 14026 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7322 Tgt 7360,7380 and 7420(Nifty Spot Levels)

Sell below 7300 Tgt 7270, 7250 and 7223 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Dear Sir ,

Just check your triangle chart, if the first candle is friday election day result candle then after that there should be 7 candles includeing today ..

Thanks Naveen.. Its updated..

Rgds,

Bramesh