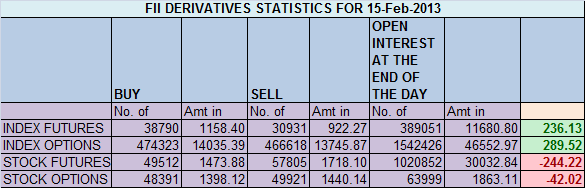

- FIIs bought 7859 contracts of Index Future worth 236 (5369 Long contracts were added and 2490 short contract were squared off ) with net Open Interest increasing by 2879 contracts, so FII’s added longs in index future after Vote of Account is over.

- Nifty has retraced the fall of Thursday in 2 days and tomorrow if able to trade above 6090 on hourly basis gives a small breakout. Range of 6113-6120 is decisive range and price action in this range needs to be closely watched. Off late trading has become very difficult for retail traders as market is not doing anything, trading in small range. “When not to trade” is most important characteristic a trader needs to develop. These whipsaws are part and parcel of trading and one good move will reward the disciplined trader.

- Nifty Future Feb Open Interest Volume is at 1.62 cores with addition of 0.4 lakhs in Open Interest,so liquidation of shorts with increase in cost of carry.

- Total Future & Option trading volume at 1.25 lakh with total contract traded at 1.67 lakh, PCR (Put to Call Ratio) at 1.01 signalling neutral zone.

- 6200 Nifty CE is having highest OI at 65.6 lakhs , remain resistance for the series,6100 CE added 0.66 Lakhs suggesting bears are not having any conviction suggesting 6100 can be crossed tomorrow.5700-6300 CE liquidated 3 Lakh in OI.FII’s sold 1.3 K contract of CE and 25.8K CE shorted were covered suggesting FII’s are again getting bullish in nifty in short term.

- 6000 PE is having highest OI at 1 core, so base at 6000 looks strong and has again acted as strong support. 6100 PE added 3.8 lakhs,having OI at 39.6 lakhs, and 6200 PE added 3 suggesting bulls want to close nifty above 6100. 5700-6300 CE added 15.7 Lakh in OI .FII’s sold 16.9 K contract of PE and 145 PE shorted PE were covered.

- FIIs bought 522 cores in Equity highest in Feb series signalling after Fiscal Deficit 4.6 was declared by FM FII’s have again got bullish on indian market,and DII sold 245 cores in cash segment.INR closed at 61.84 highest closing in 3 months.

- Nifty Futures Trend Deciding level is 6077 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6061 and BNF Trend Changer Level (Positional Traders) 10245.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6075 Tgt 6090,6106 and 6120(Nifty Spot Levels)

Sell below 6063 Tgt 6048,6022 and 6000 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/