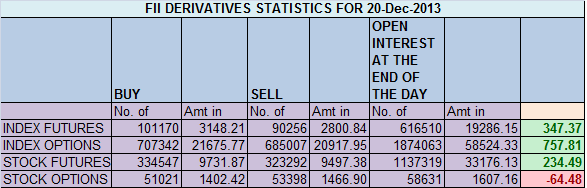

- FIIs bought 10914 contracts of Index Future worth 347 cores (21464 Longs contract were added and 10550 shorts contract were added) with net Open Interest increasing by 32014 contracts, so FII’s added longs but again not a blowout rally is offing as they added shorts.

- As discussed in last analysis Nifty closed below the upward falling channel but was holding an important 50 SMA, as shown in below chart, Nifty holded the same on panic selling on Thursday and saw the follow up move on Friday.

- Nifty Future December Open Interest Volume is at 1.8 cores with liquidation of 6 lakhs in Open Interest,with increase in cost of carry signalling short liquidation and long addition.Also 20.9 Lakh got rollovered in Jan series signalling long rollovers.

- Total Future & Option trading volume at 2.35 lakh with total contract traded at 3.03 lakh, .PCR (Put to Call Ratio) at 0.95.

- 6400 Nifty CE is having highest OI at 64.8 lakhs , still remain resistance. 6200 CE liquidated 19 lakh signalling call writers panicked today and rushed to cover there positions.No major addition in 6400 CE suggests 6300 can be top of the series.Do remember we are just 3 days of expiry as 25 Dec is a holiday. 6000-6400 CE liquidated 42 Lakh in OI, panic in bear camp.FII bought 9.4 K longs in CE,10.3 K shorted calls were covered.

- 6200 PE is having highest OI at 66.7 lakhs suggesting strong support at 6200 adding huge 21.3 lakh in OI suggesting 6200 PE writers were back with a bang, and wrote aggressively,and will be short term bottom of the market. 6300 PE added 14.4 lakh suggesting bulls want to shift base to higher level. 6000-6400 PE added 33.5 Lakh in OI.FII’s bought 5.8K in long PE and 3.3 K PE were shorted.

- FIIs bought 990 cores in Equity ,and DII sold 248 cores in cash segment.INR closed at 62.04

- Nifty Futures Trend Deciding level is 6239 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6254 and BNF Trend Changer Level (Positional Traders) 11495.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6286 Tgt 6307 ,6326 and 6357 (Nifty Spot Levels)

Sell below 6265 Tgt 6243 ,6220 and 6202 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

dear brahmesh i am reading your articles since three years & never followed & made huge losses will you please give me your contact no. i want to speak withyou personally ,hope you will do needfull .thanks.

Dear Sir,

You can contact me @09985711341

Rgds,

Bramesh

sir how to

calculate fii are in long or short