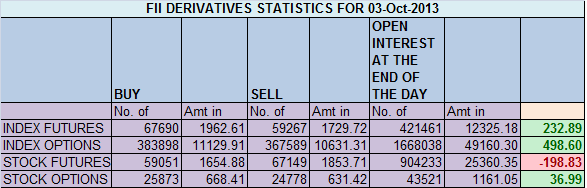

- FIIs bought 8423 contracts of Index Future (bought 8090 long contract and just 333 shorts were covered ) worth 233 cores with net Open Interest increasing by 7757 contracts.FII’s have added just 8090 longs and nifty rallying 130 points they have covered only 333 contracts still holding 25K short contracts for this series, so we are not still out of the woods.

- Nifty is stuck up in between 2 moving averages, 50 and 20 DMA and as discussed in last analysis Thursday will be a breakout/breakdown day, Nifty obliged us with a 130 points rally. Nifty has closed above 200 DMA but the bulls and bear fight is on in range of 5946-5976. Also Nifty stopped just at trendline resistance with classic example of support becoming resistance. I have said and discussed many times try to avoid trading on news, market will always surprise and give pain to majority of market participants and today was a classic day.

- Nifty Future Oct Open Interest Volume is at 1.73 cores with addition of 10 lakhs in Open Interest,with rise in cost of carry, shorts exiting out of system.Nifty Future is still trading in premium of 56 points.

- Total Future & Option trading volume at 1.01 lakh with total contract traded at 2.94 lakh.PCR (Put to Call Ratio) at 0.84, PCR also gave us hint of impending rally This is what we discussed on Monday signalling more PE are getting traded signalling bottoming out formation.

- 6000 Nifty CE is having highest OI at 35.5 lakhs with liquidation of 1.1 lakhs in OI, 5800/5900 CE liquidated 6.6 Lakhs suggesting panic in bear camp, FII’s added 26.1 K in Call option and 13 K CE were shorted. 5500-6000 CE liquidated 2.4 lakh in OI.

- 5700 PE is having the highest OI of 46.3lakhs, suggesting strong support of Nifty. 5800 PE added another 8.4 lakh suggesting 5800 can remains short term bottom for coming few days. 5900 PE added 5.1 suggesting 5900 PE writers are back in action.FII’s added 14.2 K in Put option and 10.9 K PE were shorted.5500-6000 PE added huge 23 lakh in OI signalling bulls are back in action and getting stronger each passing day.

- FIIs bought 997 cores in Equity ,and DII sold 493 cores in cash segment.INR closed at 61.74.

- Nifty Futures Trend Deciding level is 5925 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5881 and BNF Trend Changer Level (Positional Traders) 10011 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Nifty Future and Bank Nifty Future gave a very good entry at their respective trend changer levels and rewarded the discipline traders with 100 and 300 points respectively 🙂

Buy above 5920 Tgt 5946, 5970 , 5992(Nifty Spot Levels)

Sell below 5875 Tgt 5850, 5835 and 5800 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863