- FIIs sold 1312 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 39 cores with net Open Interest decreasing by 20896 contracts, so liquidation by FII and no shorts taken as of now. Should Gold be bought on Akshaya Tritiya

- As discussed in Weekly analysis for momentum to continue Nifty should cross 6120 else we can see a pullback. Nifty closed below its key psychological level of 6000. It touched a high of 6,104.95 and a low of 5972.90 in trade today. Sensex had the biggest one day fall in 14 months. The fall was accentuated by Trade deficit for April widened significantly to USD 17.8 bn as compared to around USD 10.3 bn in March. As indicated in Morning Rupee heading for breakout which was signal for market correction and bad eco data.

- Nifty Future May Open Interest Volume is at 2.13 cores with liquidation of 11.9 lakh in Open Interest with decrease in Cost of Carry of Nifty Future to showing traders are booking profit in long position .

- Total Future & Option trading volume at 1.10 lakh with total contract traded at 1.54 lakh , PCR (Put to Call Ratio) at 1.01.VIX is also reaching at 17.51 , effect of 200 DMA.Cash market volumes were quiet low suggesting todays fall was technical in nature not backed by delivery based selling.

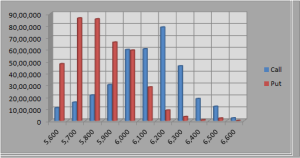

- 6200 Nifty CE is having highest OI at 78.5 lakhs with liquidation of 1.6 lakhs in OI ,6100 remains the wall of resistance as OI is at 55.3 lakhs .6000 CE added 13 lakhs in OI suggesting 6000 can act as resistance tommrow.5700-6300 CE added 11.1 Lakhs in OI.

- 5700 Put Option is having highest Open Interest of 86.2 lakhs with addition of 1.5 lakhs in OI ,5800 PE liquidated 4.7 lakhs and net OI at 85.4 lakhs,suggesting put unwinding happening, 5900 and 6000 PE unwounded 11 lakhs, suggesting panic in put writer camp..5700-6300 CE liquidated 20.4 Lakhs in OI so blow out punch by bears.

- FIIs bought in Equity in tune of 244 cores,and DII sold 454 cores in cash segment ,INR closed at 54.0 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 6018 (For Intraday Traders).Nifty Trend Changer Level 5997 and Bank Nifty Trend Changer level 12544.

Buy above 6006 Tgt 6023,6050 and 6072(Nifty Spot Levels)

Sell below 5970 Tgt 5950,5930 and 5910(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863