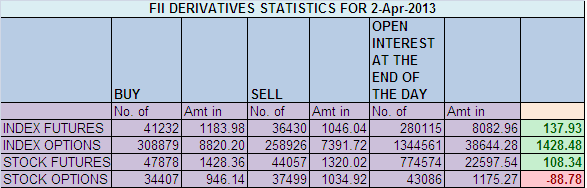

- FIIs bought 4802 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 138 cores with net Open Interest increasing by 9150 contracts. FII after long time went long in Index Futures as net OI rose with price. How to Trade New Trading Account

- Nifty continued with pullback which started after Nifty touched its 200 DMA on March 28. NS closed at 5748 after making high of 5754 and low of 5687. Nifty as soon it crossed 5722 short covering and fresh buying pushed the Index Higher. As per Weekly Analysis we discussed trend deciding level as 5703, and Nifty finally gave us the profit and covering the loss of whipsaw of yesterday’s session. With uncertainty surrounded by North South Korea , Dismissal factory output in EU but still market is rallying and traders following levels getting benefited, Avoid trading on news is the best advise i can give to readers. Develop the habbit of reading price and trade on it filtering all other noises to be successful on consistent basis.

- Nifty Future March Open Interest Volume is at 1.32 cores with addition of 10.89 lakh in Open Interest with rise in Cost of Carry of Nifty Future to showing traders are adding Long positions .

- Total Future & Option trading volume at 0.88 lakh Cores with total contract traded 1.65 lakh , PCR (Put to Call Ratio) at 0.94 and VIX at 14.10.

- 5900 Nifty CE is having highest OI at 51.8 Lakh with addition of 8.25 Lakhs,5800 CE also added 4.16 Lakhs in OI so 5800 remains key resistance.5700 CE also added 3.6 lakhs in OI. 5400-6000 CE added 17.5 Lakhs in OI

- 5600 Put Option is having highest Open Interest of 82.6 lakhs with addition of 9.1 lakhs in OI ,5700 PE added 9.8 lakhs and net OI at 57.5 lakhs.5400-6000 PE added 41.8 Lakhs in OI, 5400 PE added 11.5 lakhs and FII has net bought 1428 cores in Options suggesting hedging Futures with buying in Puts.5400-6000 PE added huge 41.8 Lakhs in OI

- FIIs sold in Equity in tune of 41cores,and DII bought 206 ,INR closed at 54.41 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 5771(For Intraday Traders). Nifty Trend Changer Level 5714, Bank Nifty Trend Changer Level 11416. Again Low made by NF was 5704 and our trend changer level 5700 gave excellent entry for longs.

Buy above 5754 Tgt 5770, 5780,5800(Nifty Spot Levels)

Sell below 5730 Tgt 5705,5687 and 5675(Nifty Spot Levels)

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

hi ramesh ,

can we se see 58oo in this expiry

Hi,

How do you arrive at Buy Above, Sell Below levels and the respective targets ?

Thanks.

Hi Sir,

These levels are generates as per the trading system.

Rgds,

Bramesh