WHAT IS COST OF CARRY?

In derivates market, the cost of carry (CoC) of a futures contract is the cost incurred on holding positions in the underlying security until the expiry of the futures. The cost includes the risk free interest rate and excludes any dividend payouts from the underlying. CoC is the difference between the futures and spot prices of a stock or index. It is commonly used to interpret market sentiment for the stock or index, as higher values of CoC indicate traders are willing to pay more for holding futures. In the case of commodity futures, CoC also includes other expenses like storage.

HOW IS IT CALCULATED?

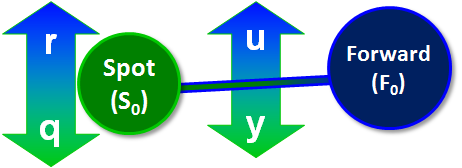

Theoretically, Future price fair value=Spot Price+Cost of Carry-Dividend Payout.

In practical terms, CoC of equity derivatives is simply calculated as the difference between the futures and spot price at any point of time. The difference is then annualized and expressed as a percentage. Stock exchange website also provide real time CoC values at the best buy,best sell and for the latest trade.

HOW IS IT INTERPRETED?

Traders often refer to CoC to guage market sentiment. Analysts interpret a significant fall inCoC as an indicator of an impending fall in the underlying. For example, CoC of benchmark index Nifty futures dropped by nearly half a fortnight ago,and served as an indicator of the consequent correction in the index.

Conversely, when the CoC for a stock future rises, it means that traders are willing to incur higher costs for holding the position and,thus,expect a rise in the underlying. CoC is expressed as an annualized figure in percentage. Average CoC of all futures contract is around 0.7-0.9%.

CAN COST OF CARRY BE NEGATIVE?

Yes. When futures trade at a discount to the underlying,the resultant cost of carry is negative. This usually happens for two reasons: when the stock is expected to pay a dividend,or when traders are aggressively executing a “reverse arbitrage” strategy,which involves buying spot and selling futures. Negative cost of carry points to bearish sentiment.

HOW DOES COST OF CARRY REPRESENT BULLISHNESS OR BEARISHNESS?

Change in CoC seen along with open interest shape a clear picture of broader sentiment for the stock or index. Open interest is the total number of open positions in a contract. For a rising OI,an increase in CoC indicates accumulation of long(or bullish) positions, while an accompanied fall in the CoC indicates addition of short positions and bearishness. Likewise,a fall in OI,accompanied with a rise in CoC,indicates closure of short positions. A falling both OI and CoC indicates that traders are closing long positions.

Analysts also observe changes in CoC at the expiry of derivatives contract. If a significant number of positions are rolled over with a higher cost of carry,it implies bullishness.

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

This is gold, Thank you so much sir.

thanks

Very useful sir. Could you please also explain about open interest and change in open interest, also how to interpret open interest in futures

sir, you have written in your blog that rising in OI and rising in CoC means bullishness.If nifty is coming down and rising in OI and CoC ,what will be the result.

Very useful sir. Could you please also explain about open interest and change in open interest, also how to interpret open interest in futures

Thanks !!

Please read this http://www.brameshtechanalysis.com/2013/09/volume-and-open-interest-analysis/

Thanx a lot Bramesh 🙂

Can you please give a blogs on arbitrage trading???

I am looking for it..

you explain good in your blogs..

Waiting for your next blog………

Hello Nilesh,

I will try to write on arbitrage trading.

Rgds,

Bramesh

Your write up are very informative and your views are very very confident and technically sound. Following you sir. Please continue your good work. With great regards,

Ram

Thanks a lot Ram !!

Rgds,

Bramesh

Very imp info, thanks for guiding all investors here.God bless u sir!

Thanks Dinesh !!

Rgds,

Bramesh

Thanks.After a long I learnt some thing. Very useful. If you could put with an example , this will help my son studies . Usually the interest rate , the bank rate, deposit /lending rate, bench mark rate , repo rate or 24%,36% like that. Thanks once again

Thanks a lot for this short but very informative post !

My Pleasure..

Rgds,

Bramesh