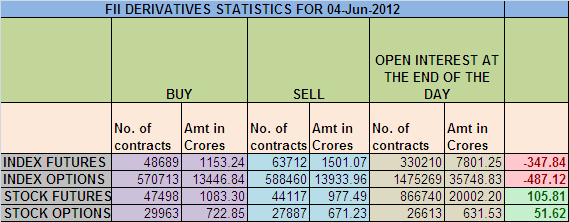

1. FII sold 15023 Contracts of NF worth 347 cores,OI increased by 25979.

2. As Nifty Future was up by 15 points and OI has increased by 25979 contracts means FII have used the rise to add shorts into the system.

3. Nifty made a low of 4770 just short of our trigger of 4767 and bounced back sharply so significance of 4767 was show today,Lets watch this level closely.

4. Bulls showed first sign of existence today with a close above 4800 and protecting 4770 in-spite of such bad global cues but will it last, A support when touched multiple times becomes prone for breakdown.You can watch the simliar example in TCS where 1194 is an important support.Break of same will lead to a breakdown trade.

5. Nifty June OI is at 1.58 cores with fresh addition of 5.2 lakhs in OI. Range as per Rollover data comes at 4825-5013.So now Keep an eye on these 2 levels 4825 on downside and 5013 on upside,Any break below 4825 will be precursor for a trending move to start and same applies above 5013. Today again on EOD basis we are able to close above 4825 as discussed in yesterdays post 🙂

6. Total F&O turnover was 0.81 lakh Cores with total contract traded at 2.71 lakh.

7. 5000 CE of June total OI now stands at 48 lakhs,Highest in June series. 5000 is the potential resistance as of now.But surprisingly 4800 CE has added the highest OI 3.17 Lakhs today so either these are weak bulls who bought in anticipation on upmove tomorrow or smart money wrote the calls,We will get a clear idea tomorrow.

8. On Put side 4500 PE is having highest OI of 65 lakhs making 4500 a strong base. 4700 PE has added the highest OI today at 7 lakhs with total OI at 46 Lakhs.FII average PE buying comes at 4883 which suggests they are active buyers of 4700 PE

9.FII sold 637 cores and DII bought 446 cores in cash segment.

10. Nifty Futures Trend Deciding level is 4725, Trend Changer at 4854 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 4852 Tgt 4866,4888 and 4914

Sell below 4767 Tgt 4744,4714 and 4690 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Hi Bramesh,

I regularly read this page after market hours….. keep up the good work…

I have couple of doubts…

1. How do you know shorts being added from Open Interest data ? I mean from which data can you interpret whether the contracts are bought or sold

2. How do you interpret the range (4825 – 5013) from the rollover data ? I searched in NSE / SEBI sites… could not find this ….

Can you pls explain