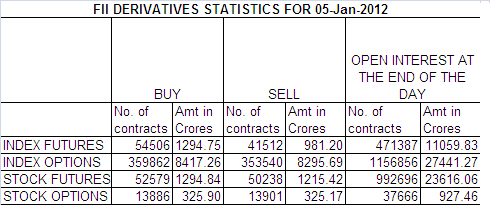

Below is my Interpretation of FII OI data Sheet for 5-Jan-11.

1. FII bought 12,994 Contracts in NF worth 313.55 Cores in Index Futures with Open Interest increasing by 23116 contracts.

2. As NF was down by 5 points and OI has increased today, As price was down marginally and FII were buyers as Price(small down tick of 5 points cannot be considered as selling) and OI both have changed in positive so some long build up. Nifty made 5 attempt today 4772,4775,4776,4779 and 4780 and all were sold off. So means selling pressure is coming to higher end.

3. Today trade in NF was quiet irritating and frustrating to most of traders as it was just trading in tight range of 40 points through out the day barring the fall we saw from 4791-4742.

4. Today we had formed an INSIDE DAY formation and from past 2 days NR7 days and tomorrow being a Weekly closing expect a range expansion tomorrow.

5. Technically today is third close above 20 SMA and it signify bulls are preparing ground to break the elusive level of 4840.

6. Today’s choppy session was on volumes 2.7 Lakh NF .Total turnover is just 70 K cores.

7. NF total OI was at 2.12 cores with 5 lakh addition in OI longs were taken by retailers and HNI

8. In Equity cash segment FII bought 381 cores whereas DII sold 289 cores.

9. As per Options data 5000 CE has highest OI of 50 lakhs addition of 2 lakh and 4500 PE has highest OI of 68 Lakhs addition of 5.68 Lakh. 5.68 lakh fresh addition is shorts in 4500PE. So 4500 looks like a good support for market for time being.

10. 4700 PE has added another 6 lakhs in OI so total of 27 lakh in 3 days which make me believe 4700 is base or support for market in immediate near term.

11. 5100 CE has seen an addition of another 1.56 Lakhs in OI so in total 9.5 lakh in past 3 trading session

12. Today 4300 PE added 9.85 lakh in OI now it would be interesting to see how it behaves tomorrow,Was it Writing by smart money. What makes me think like this is see 4200 PE it saw a liquidation of 3.6 lakh and premium is 7.2 so smart money moved out of 4200 PE and moved to 4300 PE where premium is 12 rs.

13. FII have bought Options today worth 121 cores with net OI addition of 76k.

14. FII SAR level comes at 4692. Keep this level as SL for positional longs.No change in SAR for today.

15. Today Nifty formed a double bottom by not breaking 4729 as low today was 4730 and this is bullish signal if 4730 does not get broken tomorrow.

On Upside above above 4783 Nifty Tgt 4810,4840 and 4881.

On dowside below 4725 Nifty Tgt 4696, 4676 and 4650(Nifty Spot Level)

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Dear Ramesh,

Thanks a lot for updating me regarding NR7.

Regards,

CM Gupta

Dear Sir,

Just wanted to update you my name is BRAMESH not Ramesh.

I appreciate you feedback on the some typo error i do in hurry.

Thanks a lot

Rgds,

Bramesh

Dear Ramesh,

At point no. 4, you have mentioned “Past 2 days NR7 days”

Unable to understand NR7. Is it a typing error?

Dear Sir,

NR7 is term given to a day that has the daily range smallest of last 7 days including that day.

Rgds,

Bramesh

Dear Ramesh,

At point no. 1 you mentioned FII sold, while in Point no. 2 you mentioned FII were buyers, both loks to be contradicting. there should be some typing error.

Also at point no. 2 you have mentioned “Price and Open interest was positive” which looks to be incorrect as price was negative marginally and OI was addition.

Please clarify the doubts.

Regards

CM GUPTA