Equity benchmark indices crashed for the second consecutive week, led by a fall almost in all most all sectors wherein the NIFTY has lost more than 422 points (6.7%) in the last two weeks to settle below 5900 – another psychologically important level with the SENSEX

dropping by over 1419.5 points (6.76%).

Daily Chart

Technically, the trend, which is now down and will reverse above

Stochastic is currently moving in oversold zone, on the brink of entering into deep oversold territory indicating profit booking.

RSI is trading in neutral territory at 40 showing Positive divergence.

Nifty could test its next major support around 5,840, and if Nifty breaches this level decisively, it can go down further to test 5,800 levels. On the upside, the levels of 5,960 will play major resistance and a rise above these levels can push up Nifty to 6,010 levels.

For Daily Pivot @ http://niftystockpivot.blogspot.com/

Weekly Chart

On Friday, Nifty also touched a crucial trend line support adjoining tops of October 2009 and January 2010 as shown in the weekly chart below. However, looking at the overall chart pattern, it is very much possible that Nifty corrects further and at least goes to 5750 where 20 week moving average and 38.2% retracement level of the 4786-5338 rally present a good support.

Nifty Weekly Pivot:5961

Nifty Weekly Resistance:6058 and 6221

Nifty Weekly Support:5793 and 5696

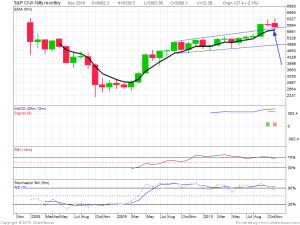

Monthly Chart

Nifty Monthly chart is showing a strong support around 5840-65 levels and we can see a decent bounce from this level if it holds and move till 6000+ in this month and Support exist at 5 EMA Monthly @5762

Nifty Monthly chart is showing a strong support around 5840-65 levels and we can see a decent bounce from this level if it holds and move till 6000+ in this month and Support exist at 5 EMA Monthly @5762

Nifty Long Term Chart

Nifty could test its next major support around 5,840, as shown in the chart and if Nifty breaches this level decisively, it can go down 5700 levels as 5840-65 range is a strong support as it can be seen in the chart.

Nifty could test its next major support around 5,840, as shown in the chart and if Nifty breaches this level decisively, it can go down 5700 levels as 5840-65 range is a strong support as it can be seen in the chart.

Hi,

Nice to see your article. it’s very informative. since last week i have been following your analysis and very nice and very useful for my learning.

BTW, Nifty pivot points are not getting updated it seems.

Thanks much.

Siva.

Thanks Siva .Your feedback are always valuable.Please let me know any more up gradation you would like to see on site.

Rgds