- FII’s sold 7.2 K contract of Index Future worth 695 cores ,4.1 K Long contract were added by FII’s and 11.4 K Short contracts were added by FII’s. Net Open Interest increased by 15.6 K contract, so rise in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 1.07. Solution of Trading Mistake which Retail Traders Make

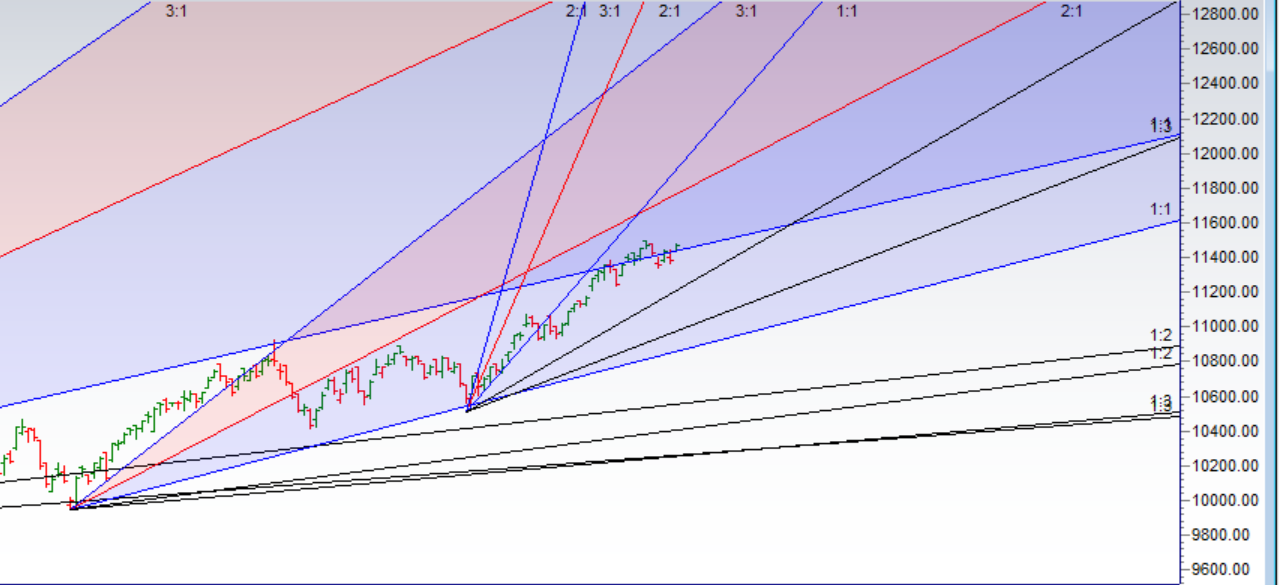

- As Discussed in Last Analysis Bulls need a close above 11410 for a move back to 11480/11555/11610. Bearish below 11343 we can see fast move towards 11290/11236. We should see good move in nifty in next 2 days. Nifty gave the good move as per our expectation opened with gap above 11410 low made 11431 and rallied towards our target of 11480. Now BUll need to close above 11500 for next round of rally towards 115555/11610. Bearish below 11390 for a move back to 11343/11290/11230. Important intraday time for reversal can be at 2:01/2:55. Bank Nifty Holds gann angle and close above 28064,EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.95 core with addition of 8.2 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @11149 closed above it.

- 11500 CE is having Highest OI at 36.5 Lakh, resistance at 11500 followed by 11600 .10500-11500 CE liquidated 18.1 lakh in OI so bears covered position in range of 11400-11500 CE. FII bought 22.6 K CE and 7 K CE were shorted by them. Retail sold 19.2 K CE and 9.3 K CE were shorted by them.

- 11300 PE OI@41.7 lakhs having the highest OI strong support at 11300 followed by 11200 . 10500-11500 PE added 13.1 Lakh in OI so bulls added position in range 11100-11200 PE. FII bought 7.7 K PE and 3.6 K PE were shorted by them. Retail bought 95 K PE and 55.8 K PE were shorted by them.

- Total Future & Option trading volume at1 5.6 Lakh core with total contract traded at 0.88 lakh , PCR @1.04

- FII’s sold 378 cores and DII’s bought 391 cores in cash segment.INR closed at 70.16 USD INR does Price Time Squaring

- Nifty Futures Trend Deciding level is 11430 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 11371. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11495 Tgt 11517,11540 and 11555 (Nifty Spot Levels)

Sell below 11450 Tgt 11430,11410 and 11385 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh