- FII’s sold 4.6 K contract of Index Future worth 353 cores ,2.9 K Long contract were liquidated by FII’s and 1.6 Short contracts were added by FII’s. Net Open Interest decreased by 1.3 K contract, so fall in market was used by FII’s to exit long and enter short in Index futures. FII’s Long to Short Ratio at 1.08 .How to stay grounded in Trading.

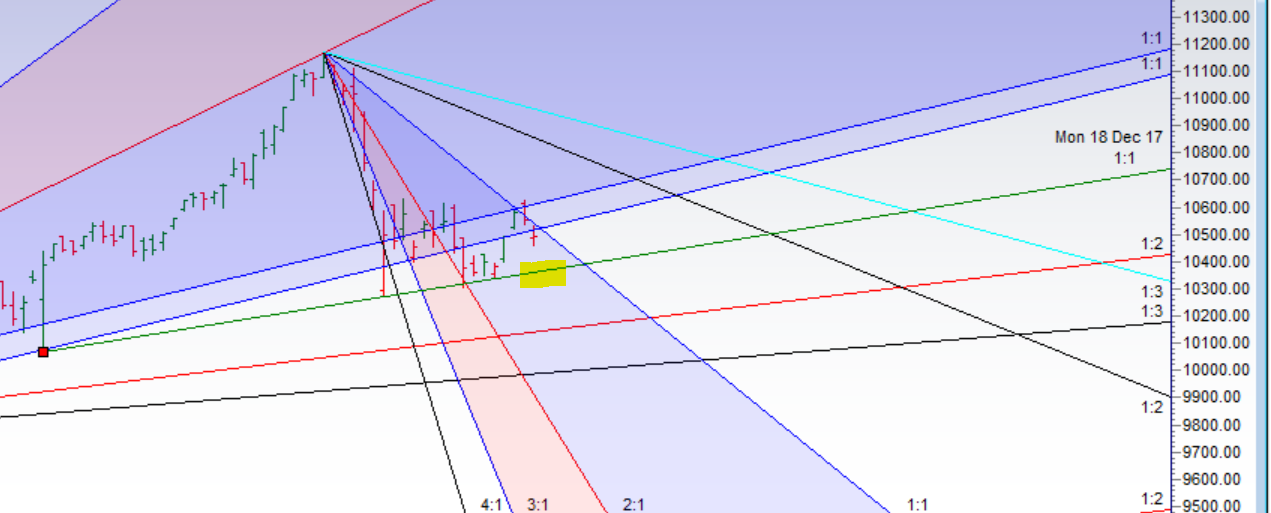

- As Discussed in Last Analysis High made today was 10631 so nifty hit the supply zone as we discussed and saw pullback. Bulls need a close above 10631 to come out of this downtrend. Nifty went below 10550 but failed to do our target and closed near 10550. Bulls need a close above 10631 and bear below 10512 and in between is no trade zone, Scalpers can buy at lower end of range and short at higher end of range. As we have monthly closing tommrow bulls need to see close above 10521 for bull run to continue for rest of the year. Nifty made high of 10535 but failed to give weekly close above 10521 which suggests trend has changed to Sell on rise till we do not see close above 10521 on Weekly basis as March is a long expiry.Bulls need a close above 10512 for a move towards 10556/10610/10666. Bearish below 10430 for a move towards 10368/10320/10276. Confluence of important time cycle date is coming on 02-04 March Important intraday time for reversal can be at 1:27. Bank Nifty analysis as we approach monthly closing

- Nifty March Future Open Interest Volume is at 2.12 core with addition of 1.6 Lakh with increase in cost of carry suggesting Long position were added today, NF Rollover cost @10395.

- Total Future & Option trading volume at 7.78 Lakh core with total contract traded at 1.4 lakh , PCR @0.87

- 10700 CE is having Highest OI at 36.8 Lakh, resistance at 10700 followed by 10900 .10000-10700 CE added 7.5 Lakh in OI so bears added position in range of 10600-10800. FII bought 7.5 K CE and 831 shorted CE were covered by them. Retail bought 70.1 K CE and 18 K CE were shorted by them.

- 10400 PE OI@37.2 lakhs having the highest OI strong support at 10400 followed by 10300 . 10300-10700 PE added 0.95 Lakh in OI so bulls added major position in 10300-10400 PE. FII bought 12.2 K PE and 6 K PE were shorted by them. Retail bought 8.9 K PE and 10.5 K PE were shorted by them.

- FII’s sold 1750 cores and DII’s bought 1596 cores in cash segment.INR closed at 65.17

- Nifty Futures Trend Deciding level is 10508 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10504 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10500 Tgt 10515,10531 and 10560 (Nifty Spot Levels)

Sell below 10480 Tgt 10458,10450 and 10420 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh