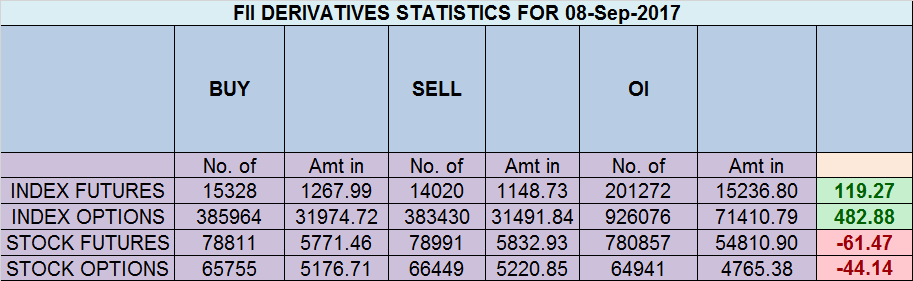

- FII’s sold 1.3 K contract of Index Future worth 119 cores ,1.1 K Long contract were added by FII’s and 175 Short contracts were liquidated by FII’s. Net Open Interest increased by 958 contract, so fall in market was used by FII’s to enter long and exit short in Index futures. FII’s Long to Short Ratio at 1.72. Build up your confidence as a trader

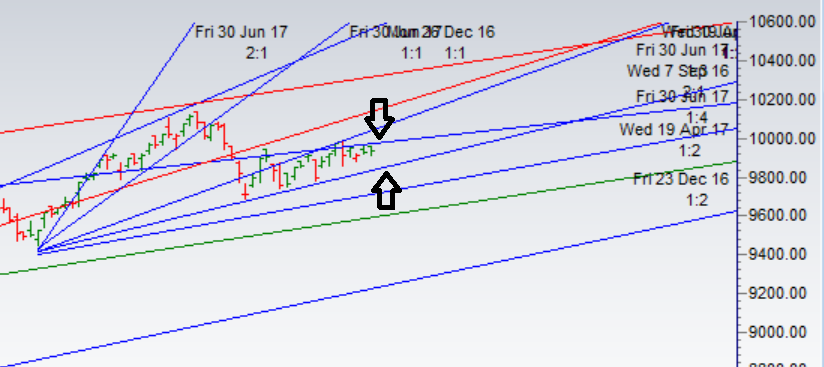

- As discussed in last analysis Breakout above 10030 for a move towards 10090/10150/10237. Bearish below 9840 for a move towards 9740/9685. Next 2 days are very crucial as per time cycle, Hopefully we can see breakout/breakdown soon. High made today was 9964 and low made was 9913 so nifty continue to stuck in between 2 gann angles and again trading near the higher end, till we trade in range of 10000-9840 ping pong continues. Breakout above 10030 for a move towards 10090/10150/10237. Bearish below 9840 for a move towards 9740/9685. New Time Cycle will start from 11 Sep so hopefully we will see a good move soon. Bank Nifty Technical Setup with New Time Cycle Starting

- Nifty September Future Open Interest Volume is at 1.94 core with addition of 2.7 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @9910 Closed above it.

- Total Future & Option trading volume at 3.30 Lakh core with total contract traded at 0.79 lakh , PCR @0.95

- 10000 CE is having Highest OI at 47.3 lakh, resistance at 10000 followed by 10200 .9500-10500 CE added 0.99 Lakh in OI so bears added major position in range of 9900-10000 CE. FII bought 3.9 K PE and 2 K PE were shorted by them. Retail bought 28.1 K PE and 23.4 K PE were shorted by them

- 9700 PE OI@52.2 lakhs having the highest OI strong support at 9700 followed by 9800. 9500-10500 PE added 12.7 Lakh in OI so bulls added position in 9500-9800 PE. FII bought 13.5 K PE and 12.8 K PE were shorted by them. Retail bought 45.2 K PE and 37 K PE were shorted by them

- FII’s sold 256 cores and DII’s bought 487 cores in cash segment.INR closed at 63.78

- Nifty Futures Trend Deciding level is 9948 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9946. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9940 Tgt 9960,9986 and 10030 (Nifty Spot Levels)

Sell below 9910 Tgt 9890,9860 and 9824 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

If fii long to short is 1:72 Then it’s huge short,Y mkt isn’t falling ?

Its Long to Short Ratio not short to long..