- FII’s sold 13.5 K contract of Index Future worth 1127 cores ,7.6 K Long contract were liquidated by FII’s and 5.9 Short contracts were added by FII’s. Net Open Interest decreased by 1.6 K contract, so rise in market was used by FII’s to exit long and enter short in Index futures. FII’s Long to Short Ratio at 1.06,For the August Series FII have net added shorts 136 K Contract till we do not close above 9910 all rallies will get sold into. Day-Traders Lose Big, Still Live in Denial

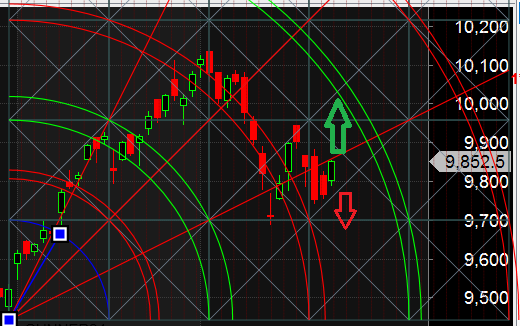

- As discussed in last analysis Bullish above 9830 for a move towards 9884/9920 towards higher side of gann angle. Bearish below 9740 break of lower end of gann angle for a move towards 9685/9610. Nifty bulls open with gap above 9786 and once 9830 was broken on upside did 9860 and still waiting for 9884/9920. As tomorrow is last day of time cycle and holiday on Friday so trade cautiously. Bearish below 9810 for a move 9751/9685. Bank Nifty EOD Analysis

- Nifty August Future Open Interest Volume is at 2.42 core with liquidation of 8.2 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @10036 Closed below it.

- Total Future & Option trading volume at 7.1 Lakh core with total contract traded at 1.06 lakh , PCR @1.02

- 10000 CE is having Highest OI at 55 lakh, resistance at 9900 followed by 10000 .9500-10000 CE liquidated 24 Lakh in OI so bears covered major position in range of 9800-9900 CE. FII bought 5.6 K CE longs and 6.1 K shorted CE were covered by them.Retail sold 57 K CE contracts and 12 K shorted CE were covered by them.

- 9800 PE OI@57 lakhs having the highest OI strong support at 9800 followed by 9700. 9400-10000 PE added 10 Lakh in OI so bulls added position in 9400-9800 PE. FII bought 226 PE and 2 K PE were shorted by them. Retail bought 67.8 K PE and 28.3 K PE were shorted by them

- FII’s sold 1157 cores and DII’s bought 929 cores in cash segment.INR closed at 64.11

- Nifty Futures Trend Deciding level is 9833 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9954. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9860 Tgt 9878,9903 and 9940 (Nifty Spot Levels)

Sell below 9830 Tgt 9805,9770 and 9742 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh