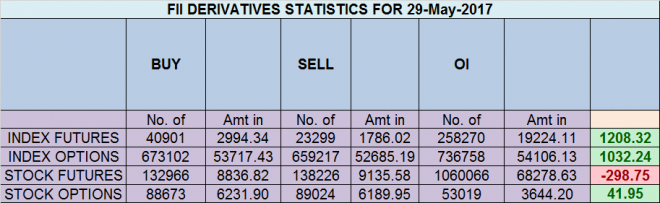

- FII’s bought 17.6 K contract of Index Future worth 1208 cores ,21.4 K Long contract were added by FII’s and 3.8 K Short contracts were added by FII’s. Net Open Interest increased by 25.2 K contract, so rise in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio has risen dramatically towards 5.7 highest in recent times How I Deal with Trading Losses

- As discussed in last analysis Now range of 9600-9610 is very important for the next move in market, Bulls need close above 9610 for next move towards 9770 and unable to close above it bears can push index towards 9500/9410. As per time cycle close above 9610 we can get another 150 points and close below 9495 we can see fall towards 9410, in between it will consolidated. Nifty made a new life high of 9637 but failed to close above 9610, Bulls need close above 9610 for the next upmove. Bears need close below 9500 in between pingpong move will continue. Bank Nifty Analysis for 30 May

- Nifty June Future Open Interest Volume is at 2.04 core with addition of 15.3 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @9435 Closed above it.

- Total Future & Option trading volume at 4.26 Lakh core with total contract traded at 1.44 lakh , PCR @0.92

- 9700 CE is having Highest OI at 39.9 lakh, resistance at 9650 followed by 9700 .9200-9700 CE liquidated 6.5 K Lakh in OI so bears covered position in 9500-9600 CE. FII bought 11.1 K CE longs and 302 CE were shorted by them.Retail bought 53.3 K CE contracts and 32.1 K CE were shorted by them.

- 9400 PE OI@48 lakhs having the highest OI strong support at 9400 followed by 9200. 9300-9700 PE added 17 Lakh in OI so bulls added aggressively in 9200-9300 PE . FII bought 3.6 K PE and 597 PE were shorted by them. Retail bought 48 K PE contracts and 44.6 K PE were shorted by them.

- FII’s sold 709 cores in Equity and DII’s bought 290 cores in cash segment.INR closed at 64.49

- Nifty Futures Trend Deciding level is 9594 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9529. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9610 Tgt 9640,9666 and 9686 (Nifty Spot Levels)

Sell below 9590 Tgt 9565,9550 and 9520(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh