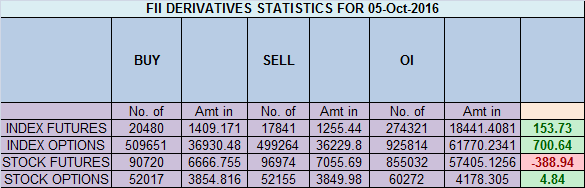

- FII’s bought 2.6 K contract of Index Future worth 153 cores ,4.6 K Long contract were added by FII’s and 2 K short contracts were added by FII’s. Net Open Interest increased by 6.7 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. The difference between winning and losing in trading

- As discussed last Analysis Nifty close above 8756 which is positive sign holding 8756 nifty will approach the gann line of resistance at 8800. Close above 8800 can see fast move towards 8840/8888. There is lot of supply in this zone, Sustaining below 8750 for an hour can quickly push index down to 8690/8656. High made today was 8806 and closed below 8756 suggesting bears have upper hand now which can push index to 8690/8656 range. Any hourly close above 8756 shorts should cut out. BUlls will now get active only on close above 8800. Bank Nifty reacts from zone of resistance,EOD Analysis

- Nifty Oct Future Open Interest Volume is at 2.22 core with addition of 1 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @8777, closed below it,trading around rollover price suggesting big move round the corner.

- Total Future & Option trading volume was at 3.82 Lakh core with total contract traded at 1.1 lakh , PCR @0.90 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 58.9 lakh, resistance at 9000 .8500/9000 CE added 8.2 lakh so bears added aggressively in range of 8800-8900 CE .FII bought 3.7 K CE longs and 3.7 K CE were shorted by them .Retail bought 68 K CE contracts and 39.1 K CE were shorted by them.

- 8600 PE OI@43 lakhs having the highest OI strong support at 8600. 8500-9000 PE added 8.4 Lakh in OI so bulls added in range of 8600-8700 .FII bought 8.6 K PE longs and 1.6 K shorted PE were covered by them .Retail bought 12.8 K PE contracts and 18.4 K PE were shorted by them.

- FII’s bought 344 cores in Equity and DII’s sold 349 cores in cash segment.INR closed at 66.51

- Nifty Futures Trend Deciding level is 8782 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8730 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8762 Tgt 8790,8835 and 8860 (Nifty Spot Levels)

Sell below 8730 Tgt 8715,8690 and 8650 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

“BUlls will now get active only on close above 8800.” who will take it to 8800+ ?

Awesome analysis sirji pls confirm the line “ANY HOURLY CLOSE ABOVE 8656 SHORTS SHOULD CUT OUT IS IT 8656 OR 8756” PLS CLEAR IT GURUDEV

Sirji waiting for ur reply

Dear Sir,

Typo error has been corrected..