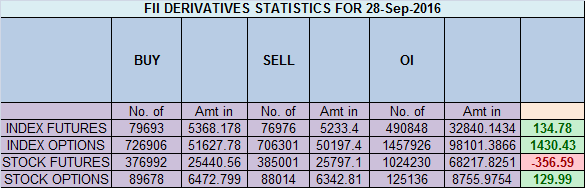

- FII’s bought 2.7 K contract of Index Future worth 134 cores ,7.9 K Long contract were added by FII’s and 5.2 K short contracts were added by FII’s. Net Open Interest increased by 13.2 K contract, so ris ein market was used by FII’s to enter long and enter shorts in Index futures. 3 Mantra of Successful Trading Part-II

- As discussed last Analysis Nifty made low of 8690 but closed above 8700, suggesting bulls can see a move till 8787/8806 holding 8700 which is also gann angle support as shown in below chart, bears will get active below 8656 for a move towards 8600/8520. Bulls continue to hold 8700 and gann angle line and pushed nifty towards 8767, but again fail to cross above 8750. Bulls need a close above 8750 for a move towards 8800/8888. We are approaching expiry tomorrow so bulls will push nifty above 8800 and bears below 8700. Option Pain at 8750 Strike price suggesting close around 8750 will be ideal for option writers. Bank Nifty hold to Gann Line at 19500, Sep Expiry Analysis

- Nifty Sep Future Open Interest Volume is at 1.72 core with liquidation of 33.2 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8686, closed above it rallied 250 points.

- Total Future & Option trading volume was at 5.95 Lakh core with total contract traded at 1.47 lakh , PCR @0.94 , Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 46.3 lakh, resistance at 8800 .8700/8850 CE liquidated 8.7 lakh so bears ran for cover in 8700-8750 CE .FII bought 11.9 K CE longs and 5.2 K CE were shorted by them .Retail sold 33 K CE contracts and 4.6 K CE were shorted by them.

- 8700 PE OI@58 lakhs having the highest OI strong support at 8700. 8700-8850 PE added 21 Lakh in OI so bulls added aggressively in 8700/8750 PE, suggesting any break below 8700 can see huge unwinding and can lead to fast move on downside .FII bought 17.4 K PE longs and 3.5 K PE were shorted by them .Retail bought 33 K PE contracts and 30.5 K PE were shorted by them.

- FII’s bought 73 cores in Equity and DII’s sold 69 cores in cash segment.INR closed at 66.46

- Nifty Futures Trend Deciding level is 8747 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8803 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8750 Tgt 8773,8800 and 8833 (Nifty Spot Levels)

Sell below 8705 Tgt 8690,8675 and 8650 (Nifty Spot Levels)

Upper End of Expiry:8808

Lower End of Expiry:8681

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh